As the fintech industry reshapes the financial landscape, a new approach to marketing has emerged to address its unique challenges—MarketingFi. This fusion of marketing and finance is revolutionizing how fintech companies engage with customers, combining the latest technologies, data insights, and principles from decentralized finance (DeFi) to deliver hyper-personalized and highly secure customer experiences. This article explores what MarketingFi is and how it’s redefining the role of marketing in fintech. From harnessing blockchain and AI to leveraging data-driven strategies, MarketingFi is helping fintech companies build trust, enhance engagement, and reach new audiences in ways that traditional marketing methods simply can’t achieve. Dive in to discover how MarketingFi is shaping the future of customer interactions in the fast-paced fintech world.

What is MarketingFi?

MarketingFi, or Marketing Finance, blends finance and marketing strategies to help fintech companies make smarter, data-backed marketing decisions. Unlike traditional marketing approaches, MarketingFi uses advanced analytics, blockchain technology, and DeFi mechanisms to create customer-centric campaigns that are secure, transparent, and tailored to individual preferences. It empowers companies to target customers more precisely, optimizing marketing budgets while delivering greater ROI.

How MarketingFi Transforms Fintech Marketing

Nowadays, MarketingFi transforms Fintech Marketing in terms of different ways, including:

Personalization and Data-Driven Targeting

MarketingFi harnesses big data and machine learning to create campaigns tailored to each customer’s preferences, habits, and financial behaviors. This level of personalization not only enhances the user experience but also leads to higher conversion rates and customer loyalty.

Decentralization and Transparency

With blockchain technology, MarketingFi can introduce transparency and accountability in advertising spending, allowing customers to see exactly how their data is used. This fosters trust, as users gain more control over their personal information and benefit from fairer, more transparent advertising.

Tokenization and Loyalty Programs

MarketingFi incorporates DeFi principles, enabling fintech companies to use digital tokens for customer rewards and loyalty programs. These tokens can be traded, used for purchases, or invested, creating a unique value proposition that incentivizes customer engagement.

Enhanced Security

By leveraging blockchain, MarketingFi ensures that customer data and financial information remain secure. This is especially valuable in the fintech world, where data security is critical to maintaining trust and compliance with regulations.

How MarketingFi Differs from Traditional Marketing in Fintech

Customer-Centric Approach Over Product-Centric Advertising

Rather than pushing products, MarketingFi places the customer’s experience, goals, and pain points at the center of the message. MarketingFi empowers customers to make informed financial decisions, providing them with personalized tools, financial education, and customized advice.

Leverage of Advanced Technologies

AI, machine learning, and blockchain are foundational to MarketingFi. AI-driven data analytics allow fintech companies to gather insights about customer behavior, offering a more targeted approach. Blockchain enhances trust by promoting data security, while smart contracts can even automate customer rewards programs.

Decentralization and Transparency

Unlike traditional finance marketing, which could be opaque, MarketingFi leverages DeFi principles to improve transparency. Blockchain-based campaigns give customers insight into how their data is used, fostering trust through decentralized data-sharing and reward systems.

Inclusion Through Accessibility

MarketingFi strategies strive to remove the barriers that prevented many from accessing traditional finance products. By offering a broad range of products—from microloans to tokenized investments—MarketingFi empowers a diverse audience to engage with and benefit from fintech services.

Interactive and Community-Driven Engagement

MarketingFi includes community-building efforts such as educational resources, social media engagement, and virtual events that allow users to learn, connect, and grow. This creates a sense of belonging, turning customers into loyal advocates and building stronger, more enduring relationships.

Key Components Driving MarketingFi in Today’s Fintech Landscape

Hyper-Personalization

Using AI and machine learning, fintech companies create dynamic, individualized campaigns that adapt to users in real time. Personalized dashboards, push notifications, and unique offers are designed to keep customers engaged and informed.

Incentivized Engagement with Tokenization

Tokenized rewards and loyalty programs offer customers tangible benefits for interacting with the brand. This gamification of finance helps drive customer engagement and loyalty in a way that traditional rewards programs cannot.

Educational Content

MarketingFi places a significant emphasis on financial literacy. By offering valuable content in the form of blogs, videos, webinars, and interactive tools, fintech brands position themselves as trusted advisors, helping users build their knowledge and confidence.

The Future of MarketingFi: What’s Next?

As fintech continues to grow, MarketingFi will likely evolve alongside it, incorporating innovations like:

- DeFi Integration: More fintechs will integrate DeFi products, allowing customers to participate in decentralized savings accounts, loans, and investments through intuitive marketing campaigns.

- Advanced Predictive Analytics: AI-powered predictions will improve further, enabling fintechs to anticipate customer needs with impressive accuracy and preemptively offer relevant services.

- Augmented Reality (AR) and Virtual Reality (VR): These immersive technologies could bring a new level of engagement, allowing customers to visualize financial goals or investment portfolios in interactive, virtual environments.

Conclusion

In short, understanding what is MarketingFi is very important due to its emergence at the present. MarketingFi has transformed fintech marketing from static ads and generic messaging to highly interactive, personalized, and transparent customer experiences. This approach is not just about marketing a product; it’s about building meaningful, long-term relationships that empower customers in their financial journeys. As fintech continues to push boundaries, MarketingFi will remain essential, shaping a new era of financial inclusivity, trust, and innovation that will define the future of finance.

About Herond Browser

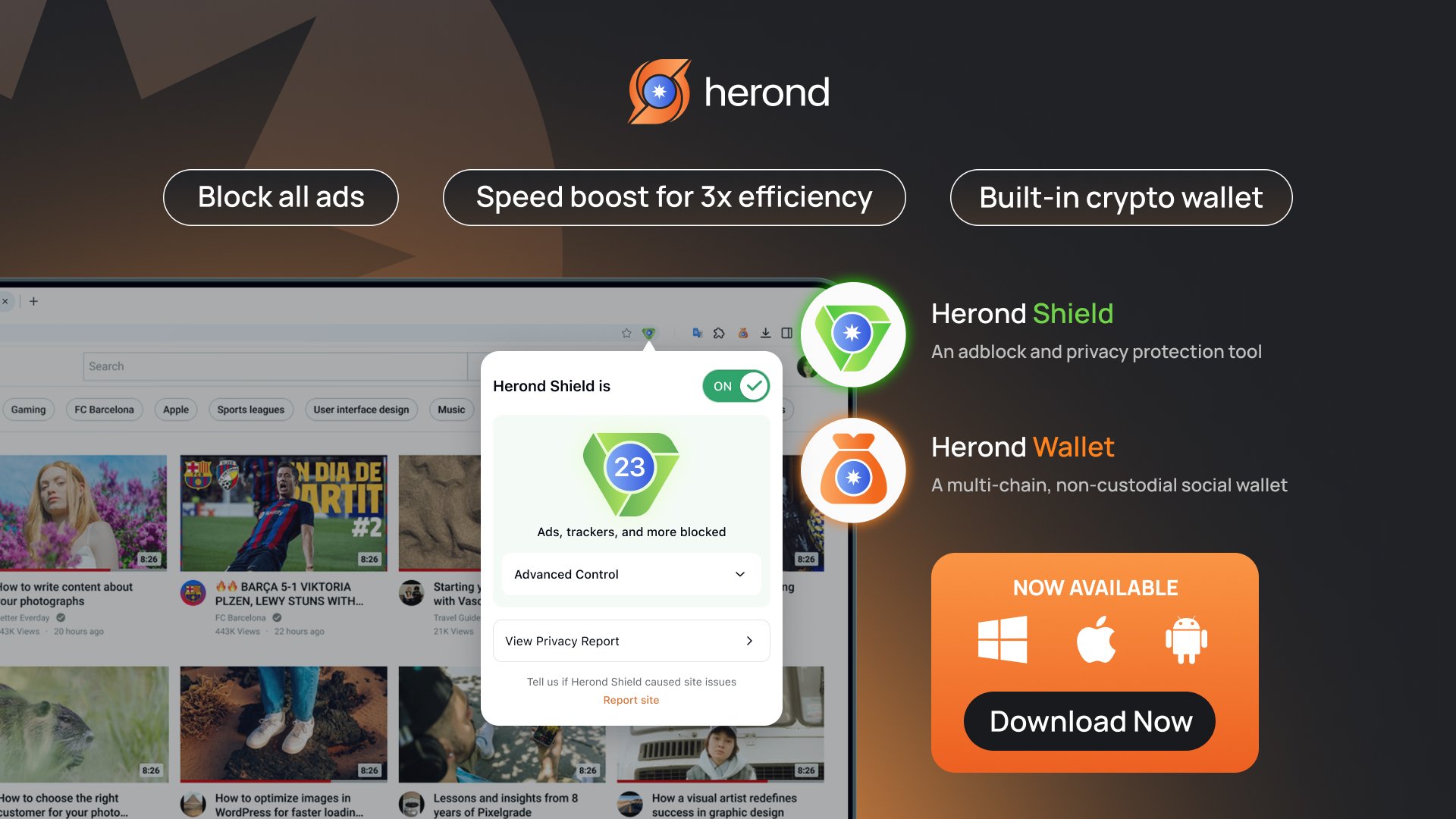

Herond Browser is a Web browser that prioritizes users’ privacy by blocking ads and cookie trackers, while offering fast browsing speed and low bandwidth consumption. Herond Browser features two built-in key products:

- Herond Shield: an adblock and privacy protection tool;

- Herond Wallet: a multi-chain, non-custodial social wallet.

Herond aims at becoming the ultimate Web 3.0 solution, heading towards the future of mass adoption. Herond has now released the mobile version on CH Play and App Store. Join our Community!