Confused about Fintech and DeFi in 2025? You’re not alone. Fintech powers everyday money apps (think instant transfers, contactless payments, and AI budgeting), while DeFi (Decentralized Finance) lets you lend, borrow, or trade without banks – all on blockchain, 24/7, globally. With Herond Wallet, you can store crypto securely, swap tokens in seconds, and earn yield directly from your phone – no middleman, no hidden fees. In this simple 2025 guide, we break down What is Fintech and Defi, how they work together, and how to make it easy for everyone to join. Let’s dive in!

What is Fintech? (Traditional Finance + Technology)

Simple Definition

Fintech stands for Finance + Technology – a powerful combo that turns complex money tasks into simple, fast, and secure apps. From sending cash in seconds with a tap, paying contactless at stores, to budgeting with AI that tracks every penny, Fintech makes finance work for you, not against you. In 2025, it’s not just for banks anymore: Herond Wallet brings Fintech to your pocket with instant crypto transfers, zero-fee swaps, and smart savings tools – all protected by top-tier security.

Real-Life Examples (2025):

| Fintech Type | App Example | What It Does |

| Mobile Payments | Momo, ZaloPay | Pay QR code in 2s |

| Digital Banking | Timo, Cake | Open account in 5 mins |

| Buy Now Pay Later | Fundiin | Pay in 4 installments |

What is DeFi? (Decentralized Finance = Finance Without Banks)

Simple Definition

DeFi means Finance on Blockchain – you become your own bank, with no KYC, no middleman, and no permission needed. Lend your crypto to earn interest, borrow instantly, or swap tokens globally – all 24/7, directly from your wallet. You control your keys, your funds, and your future – DeFi gives power back to you.

Top DeFi Activities in 2025:

Lending -> Aave, Compound (earn 5-20% APY)

Staking -> Ethereum, Solana (lock coins, earn rewards)

Fintech vs DeFi: Side-by-Side Comparison (2025)

| Feature | Fintech (Centralized) | DeFi (Decentralized) |

| Control | Bank/App owns your data | You control your wallet |

| Speed | Fast (seconds) | Fast (seconds to minutes) |

| Fees | Low (0–2%) | Gas fees (varies by chain) |

| KYC Required? | Yes | No |

| Examples | Momo, VPBank | Uniswap, Aave |

| Risk | Low (regulated) | High (hacks, scams) |

What is Fintech and Defi? – Risks You Must Know (Beginner Warning)

- Fintech Risks:

App crashes, data leaks, account freezes: Apps can crash during transfers; poor security leads to hacked personal data.

- DeFi Risks:

Smart contract bugs, rug pulls, lost private keys: Code errors drain funds; fake projects vanish with money; lose seed phrase = lose all crypto forever.

Future of Fintech & DeFi in 2025 and Beyond

- Fintech

AI analyzes data for faster, fairer loans; voice payments enable hands-free transactions via Siri/Alexa; CBDC integration uses digital currencies like Vietnam’s pilot Digital Dong (launched 2025 via blockchain for efficient, secure payments without replacing fiat VND).

- DeFi

Layer 2, like Arbitrum/Polygon, speeds up transactions with low fees on Ethereum; real-world assets tokenize physical items (e.g., gold/real estate as NFTs) for fractional ownership and 24/7 trading.

- Prediction

McKinsey forecasts DeFi will drive half of global banking via embedded finance and blockchain, shifting from traditional models to decentralized, AI-enhanced services (projected $79.4B digital banking market).

How to Start with Fintech & DeFi Today (3-Step Guide)

- Download a Fintech App

Momo: Vietnam’s top e-wallet super app with 30M+ users in 2025; features instant QR payments, bill pay, investments, and AI personalization – no fees for transfers up to 1B VND/day, regulated by State Bank of Vietnam for secure cashless transactions.

Timo: Digital-only bank app (no branches) for seamless banking; offers free 24/7 transfers to all banks, high-interest savings (up to 7%), and debit cards at 17K+ ATMs – ideal for expats with easy account opening via app.

- Get a Crypto Wallet

Trust Wallet: Mobile-first non-custodial wallet supporting 100+ blockchains (e.g., Solana, Ethereum); built-in staking (5-15% APY), NFT storage, and dApp browser – Binance-backed for secure, user-friendly DeFi access without KYC.

MetaMask: Browser extension/mobile app focused on EVM chains (Ethereum, Polygon). It enables easy dApp connections, token swaps (0.875% fee), and staking – perfect for desktop DeFi with custom RPCs and privacy tools.

Conclusion

Fintech makes money easy, fast, and secure – from AI budgeting to voice payments – while DeFi puts you in full control as your own bank on blockchain, no middleman, 24/7 access. The future of money is in your hands – download Herond today and step confidently into Fintech + DeFi. Ready to own your financial future? Comment below: Fintech or DeFi – which will you try first? 🚀

About Herond

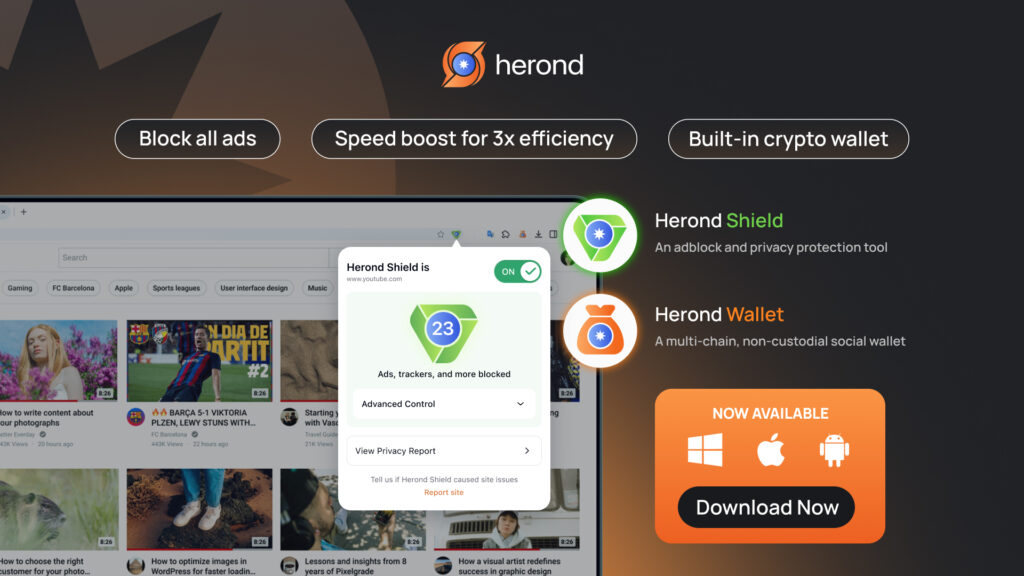

Herond Browser is a cutting-edge Web 3.0 browser designed to prioritize user privacy and security. By blocking intrusive ads, harmful trackers, and profiling cookies, Herond creates a safer and faster browsing experience while minimizing data consumption.

To enhance user control over their digital presence, Herond offers two essential tools:

- Herond Shield: A robust adblocker and privacy protection suite.

- Herond Wallet: A secure, multi-chain, non-custodial social wallet.

As a pioneering Web 2.5 solution, Herond is paving the way for mass Web 3.0 adoption by providing a seamless transition for users while upholding the core principles of decentralization and user ownership.

Have any questions or suggestions? Contact us:

- On Telegram https://t.me/herond_browser

- DM our official X @HerondBrowser

- Technical support topic on https://community.herond.org