Ever wonder how big companies stay ahead of financial risks or keep their costs low despite market chaos? The answer often lies in a powerful financial tool called a swap. Swaps are like behind-the-scenes deals where two parties agree to trade cash flows or assets to manage risks and seize financial opportunities. Whether it’s dodging interest rate spikes or shielding against currency swings, swaps give businesses the flexibility they need to stay competitive. What is Swap? Let’s dive into the world of swaps and discover how they quietly drive smart financial decisions across industries.

Learn more: Understanding the Benefits and Challenges of ICOs

What is Swap?

What is Swap? A swap is a financial agreement where two parties agree to exchange cash flows or financial assets over a set period. This exchange usually helps businesses manage financial risks, like changing interest rates or currency values, and can also help lower costs. For example, two companies might agree to swap payments—one pays a fixed interest rate while the other pays a floating rate. This lets each company balance its financial plans with market conditions.

Swaps are flexible and can be customized to meet the specific needs of both sides. They’re commonly used by big companies and financial institutions to protect themselves from market changes or to access new financial opportunities.

However, most swaps are private deals (called over-the-counter or OTC contracts), meaning they aren’t traded on public markets. This makes them more flexible but also riskier since each party must trust the other to stick to the deal.

Overall, swaps are powerful tools in finance, helping businesses manage risks and make smarter financial decisions.

Learn more: The Role of Technical Analysis in Crypto Trading

How does Swap work?

After learning “What is Swap?”, we should have a look at how it woks. A swap works as a financial agreement between two parties to exchange cash flows or assets over a specific period, based on pre-agreed terms. The main goal is to help both sides manage financial risks, such as interest rate fluctuations or currency volatility, and sometimes to lower borrowing costs.

Here’s a simple breakdown of how swaps work:

- Initial Agreement:

Both parties agree on the contract terms, which include the notional amount (the underlying amount used to calculate payments), the type of interest rates (fixed or floating), payment frequency, and the contract’s duration. - Cash Flow Exchange:

Throughout the contract, the parties regularly exchange payments as outlined in the agreement. For instance, in an interest rate swap, one party might pay a fixed rate while receiving payments based on a floating rate from the other side. - Contract Completion:

When the swap ends, both sides fulfill any remaining payment obligations. In some swaps, the original principal amounts are exchanged back at this stage.

5 Popular Types of Swap Contracts

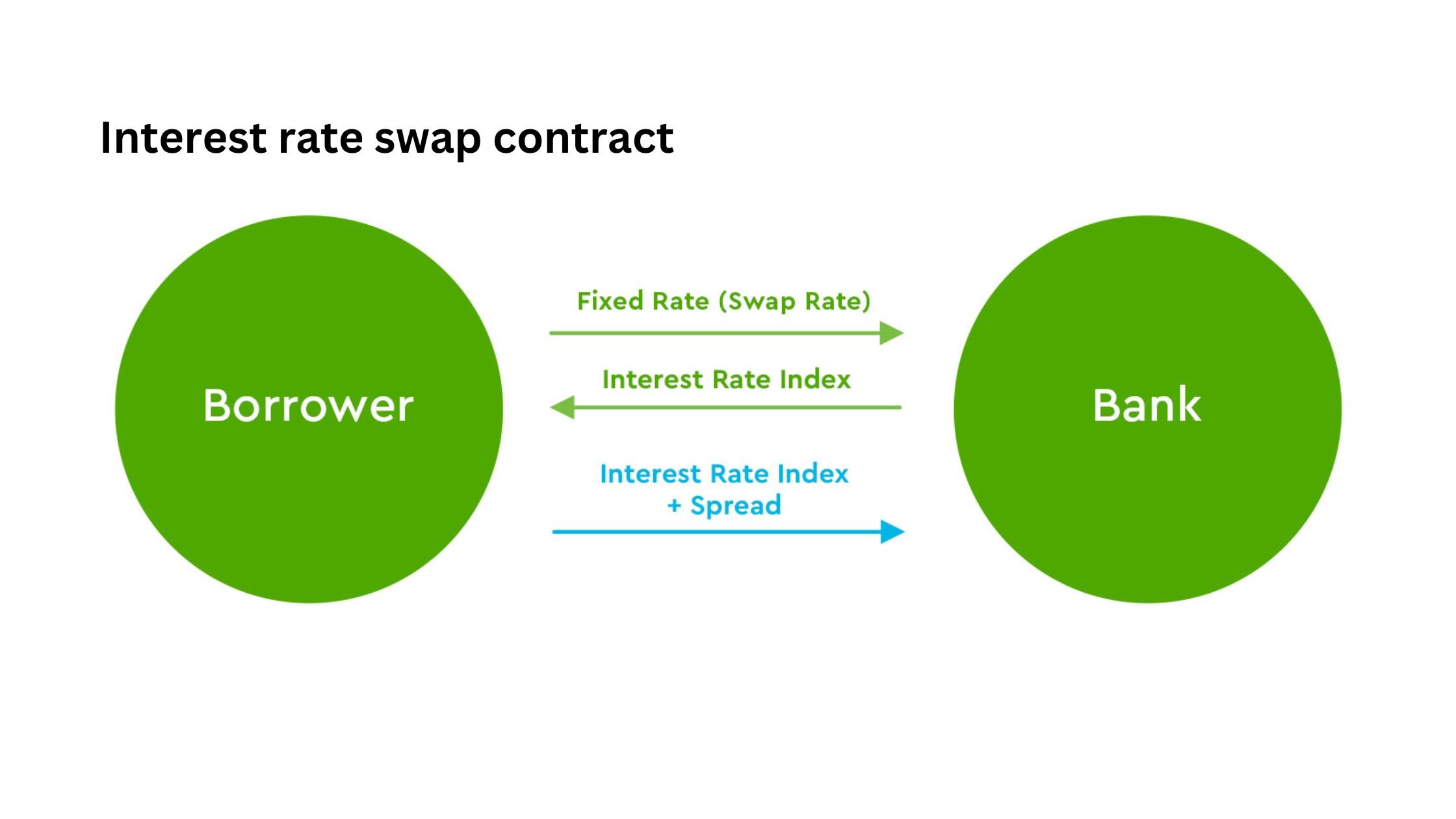

Interest Rate Swap (IRS)

An Interest Rate Swap (IRS) is a financial agreement between two parties to exchange interest payments on a notional principal amount. Typically, one party pays a fixed interest rate while the other pays a floating rate. The primary goal is to manage interest rate risk and optimize financial costs.

Key Features:

- Notional Principal: Used to calculate interest payments but isn’t actually exchanged.

- Payment Structure: Interest payments are exchanged periodically—monthly, quarterly, or annually—based on the agreed fixed or floating rate.

- Flexible Duration: Contracts usually last from 1 to 5 years, depending on the agreement.

- Effective Risk Management: Helps companies stabilize borrowing costs or maximize investment returns by reducing exposure to interest rate fluctuations.

- Cost Savings: Allows parties to capitalize on market interest rate differences to lower financial expenses.

- Financial Flexibility: Supports organizations in adjusting debt or asset interest structures to fit their financial strategies.

Interest rate swaps are widely used by corporations, banks, and investors to manage debt risks and take advantage of changing market rates.

Currency Swap Contract

A Currency Swap Contract is a financial agreement between two parties to exchange principal amounts and interest payments in different currencies. In this arrangement, each party receives a principal amount and pays interest in one currency while simultaneously paying the principal and interest in another currency.

Key Features:

- Principal Exchange: Both parties exchange principal amounts at an agreed-upon exchange rate at the start of the contract and reverse the exchange when the contract matures.

- Interest Payments: Throughout the contract term, both parties make periodic interest payments on the exchanged principal. These interest rates can be either fixed or floating, depending on the agreement.

- Combination with Interest Rate Swaps: In markets like Vietnam, currency swaps are often combined with interest rate swaps to enhance financial risk management.

- Risk Management Tool: Currency swaps are crucial for managing foreign exchange risk, optimizing borrowing costs, and leveraging interest rate differences between global markets.

Currency swaps are widely used by multinational corporations and financial institutions to hedge against currency fluctuations and secure more favorable borrowing terms in foreign markets. This flexibility allows companies to access foreign capital while minimizing exposure to volatile exchange rates.

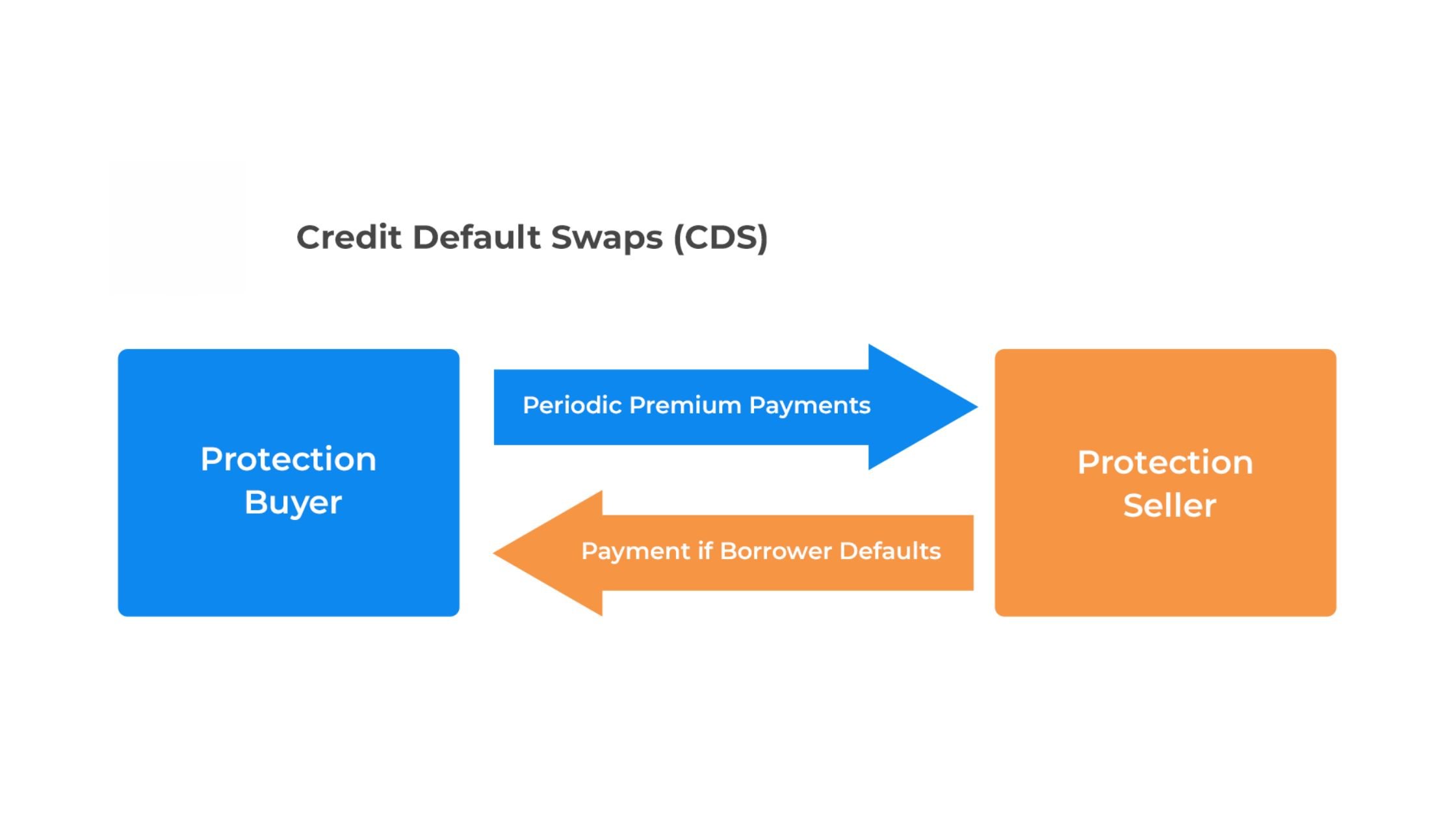

Credit Default Swap (CDS) Contract

A Credit Default Swap (CDS) is a financial agreement where the buyer of the contract pays periodic fees to the seller in exchange for protection against the risk of a debt issuer (such as a corporation or government) defaulting on its obligations. Essentially, a CDS acts like insurance for loans or bonds, providing a safety net in case of credit events.

Key Features:

- Regular Premium Payments: The CDS buyer pays regular premiums to the seller throughout the contract term, similar to paying insurance premiums.

- Payout on Credit Events: If the debt issuer defaults or experiences a credit event (like bankruptcy or missed payments), the CDS seller compensates the buyer for part or all of the loss.

- No Need to Own the Debt: Buyers of a CDS don’t need to own the underlying debt or bonds to purchase protection, allowing more flexibility in risk management.

- High Liquidity: CDS contracts can be traded on secondary markets, enabling investors to easily buy or sell protection as market conditions change.

- Counterparty Risk: If the CDS seller defaults, the buyer might not receive the promised payout, introducing potential counterparty risk.

CDS contracts are vital tools for managing credit risk, especially in volatile markets. They allow investors and financial institutions to hedge against potential defaults while also offering speculative opportunities for those willing to take on risk. However, the 2008 financial crisis highlighted how excessive use of CDS without proper risk controls can contribute to systemic financial instability.

Commodity Swap Contract

A Commodity Swap is a financial agreement between two parties to exchange cash flows based on the price of a specific commodity. In this contract, one party agrees to pay a fixed price for the commodity, while the other pays a variable amount tied to the market price. Common commodities involved in these swaps include crude oil, natural gas, metals, agricultural products, and other raw materials.

Key Features:

- No Physical Delivery: The agreement involves only cash settlements based on price differences—no physical exchange of the actual commodity occurs.

- Price Risk Hedging: Commodity swaps help businesses stabilize production costs or secure profits despite volatile commodity prices. This is especially valuable for industries heavily reliant on raw materials.

- Scheduled Payments: Payments are made at agreed intervals—monthly, quarterly, or based on other predefined periods—allowing predictable cash flow management.

- Flexible Applications: Commodity swaps are widely used by producers, suppliers, and investors looking to hedge against price fluctuations or speculate on market trends.

- Financial Optimization: By locking in commodity prices, businesses can better plan budgets and safeguard profit margins, enhancing overall financial stability.

Commodity swaps are essential for industries facing unpredictable market prices, offering a strategic tool to manage risks and improve financial planning. For example, an airline company might use a commodity swap to fix fuel costs, protecting itself from sudden spikes in oil prices, while commodity traders may use these swaps to speculate on future price movements without handling physical goods.

Equity Swap Contract

An Equity Swap is a financial agreement between two parties to exchange cash flows based on the performance of a specific stock or stock index. In this contract, one party pays returns linked to the performance of a stock or index, while the other pays a fixed or floating interest rate. This tool allows investors to gain exposure to equity markets without directly owning the underlying stocks.

Key Features:

- No Ownership Required: Participants can benefit from stock price movements without actually buying or holding the underlying shares.

- Risk Hedging: Equity swaps help investors and financial institutions protect their portfolios from stock price volatility.

- Tax Efficiency: Some investors use equity swaps to minimize tax liabilities associated with direct stock trading, depending on jurisdiction.

- Regular Payments: Cash flows are exchanged at agreed intervals (quarterly, annually) based on the performance of the underlying asset.

- Investment Flexibility: Investors can easily access various equity markets worldwide without facing legal or trading restrictions.

Equity swaps are powerful tools for diversifying investment portfolios, optimizing returns, and managing risks in the stock market. For example, a hedge fund might use an equity swap to gain exposure to foreign stock indices without dealing with international trading regulations, while a bank could hedge its stock holdings against potential losses.

Conclusion

What is Swap? Swaps might seem complex at first glance, but they’re vital tools that help businesses stay agile in unpredictable markets. From managing interest rates to protecting against currency shifts, swaps empower companies to control risks and sharpen their financial strategies. Whether you’re a business leader, an investor, or just curious about how financial markets tick, understanding swaps opens up a world of possibilities. In today’s fast-moving economy, knowing ‘what is swap?’ and how swaps work isn’t just smart—it’s essential.

Learn more: Pump and Dump in Cryptocurrency: A Growing Threat in the Digital Asset Market

About Herond Browser

Herond Browser is a cutting-edge Web 3.0 browser designed to prioritize user privacy and security. By blocking intrusive ads, harmful trackers, and profiling cookies, Herond creates a safer and faster browsing experience while minimizing data consumption.

To enhance user control over their digital presence, Herond offers two essential tools:

- Herond Shield: A robust adblocker and privacy protection suite.

- Herond Wallet: A secure, multi-chain, non-custodial social wallet.

As a pioneering Web 2.5 solution, Herond is paving the way for mass Web 3.0 adoption by providing a seamless transition for users while upholding the core principles of decentralization and user ownership.

Have any questions or suggestions? Contact us:

- On Telegram https://t.me/herond_browser

- DM our official X @HerondBrowser

- Technical support topic on https://community.herond.org