Have you ever wanted to invest in stocks or bonds, but felt overwhelmed by the sheer number of options? If you’re new to investing, it might sound like a puzzle. But what if you could simply pool your money with others to invest in a variety of assets without doing all the heavy lifting? That’s where mutual funds come in. Let’s break it down!

Learn more: Understanding the Benefits and Challenges of ICOs

What Are Mutual Funds?

In simple terms, mutual funds are investments that pool money from lots of different investors. Then, a professional manager uses that pooled money to buy a mix of stocks, bonds, and other assets. Instead of buying individual stocks or bonds yourself, you invest in a mutual fund and let experts handle the details.

The real magic of mutual funds is diversification. By investing in a fund, you’re spreading your risk across a range of different assets. If one stock or bond performs poorly, others in the fund might do better, balancing things out.

Learn more: A Beginner’s Guide to Doing Your Own Research (DYOR) in Cryptocurrency

How Do Mutual Funds Work?

Imagine you and a group of friends each throw some cash into a pot. A fund manager is the one who decides how to invest that money. The best part? You don’t have to worry about picking individual stocks or bonds. The fund manager does it all for you.

Mutual funds can be:

- Actively managed: A team of experts picks investments and changes them regularly to try to outperform the market.

- Passively managed: These funds track a market index (like the S&P 500) and have lower fees since no one is actively picking stocks.

You earn money from mutual funds in three main ways:

- Dividends: When the fund holds stocks that pay dividends, you’ll get a share of that income.

- Capital Gains: When the fund sells an asset for a profit, you get a cut of the earnings.

- NAV Growth: If the value of the assets in the fund increases, the price of your shares in the fund goes up too.

Types of Mutual Funds

There are many types of mutual funds, and each serves a different purpose depending on your financial goals.

- Equity Funds: These funds invest mostly in stocks. They’re great for people looking for higher potential returns and willing to take on more risk.

- Fixed Income Funds: These focus on bonds and other debt instruments. They’re less risky but typically offer lower returns than equity funds.

- Index Funds: A passive option that tracks a specific market index, like the S&P 500. These funds are generally low-cost and perform similarly to the overall market.

- Balanced Funds: These invest in a mix of stocks and bonds to provide both growth and stability.

Each of these types fits different investment strategies. So, whether you want aggressive growth or steady income, there’s a mutual fund for you.

4 Benefits of Investing in Mutual Funds

Investing in mutual funds comes with several key advantages that make them a popular choice for both beginners and experienced investors. Here’s why mutual funds might be the right choice for you:

Diversification: Reducing Risk

Instead of putting all your money into one or two stocks, mutual funds pool your money with other investors and invest in a variety of assets like stocks, bonds, and sometimes even real estate. This means your investment is spread across dozens or even hundreds of different securities, which helps reduce risk. If one asset performs poorly, others in the fund may perform better, balancing out the losses.

Professional Management: You Don’t Have to Be an Expert

One of the biggest perks of mutual funds is that you don’t need to be a financial expert to get started. Fund managers—professional investors with deep knowledge of the market—handle all the decision-making for you. They decide which stocks or bonds to buy, when to buy them, and when to sell, ensuring your portfolio is actively managed according to the fund’s strategy.

Low Costs: Affordable Investment Options

Mutual funds, especially index funds, tend to have lower costs compared to other investment types. Index funds are passively managed and track a market index (like the S&P 500), so their fees are minimal. While actively managed funds can have higher fees due to professional management, the low-cost options in mutual funds make them an affordable choice for many investors.

Accessibility: Invest with Any Budget

Whether you have $100 or $10,000 to invest, mutual funds offer an accessible way to enter the market. Because you can buy shares in a fund, you don’t need large amounts of money to gain exposure to a diverse set of assets, making them perfect for investors at all financial levels.

Learn more: What is a Validator? A Guide to Proof of Stake

How Much Can You Make from Investing in Mutual Funds?

Let’s put it into perspective. If you invested $10,000 in a mutual fund that performed at an average annual return of 7% (a reasonable figure over the long term), here’s how your investment could grow over time:

- After 1 year: You’d have $10,700.

- After 5 years: Your investment would grow to around $14,025.

- After 10 years: You’d have around $19,671.

Of course, mutual funds can go up or down in value, and returns are never guaranteed. But over time, they offer the potential for steady growth.

The 3-5-10 Rule for Mutual Funds

Here’s a simple guideline: the 3-5-10 rule. It suggests that you should consider holding onto your mutual fund investment for different periods based on performance:

- 3 Years: Evaluate if the fund is doing what it should. Are you seeing growth?

- 5 Years: You should see decent returns by this point. If not, it might be time to reassess.

- 10 Years: Historically, mutual funds are a long-term play. Over a decade, the odds of your investment performing well are much higher.

Mutual Funds vs. ETFs: What’s the Difference?

You might have heard of ETFs (Exchange-Traded Funds), and while they’re similar to mutual funds, there are a few key differences:

- Liquidity: ETFs can be traded throughout the day, just like stocks. Mutual funds, on the other hand, are bought or sold at the end of the day based on their Net Asset Value (NAV).

- Costs: ETFs usually have lower fees because they’re often passively managed. Mutual funds, especially actively managed ones, tend to have higher fees.

- Flexibility: ETFs are more flexible, allowing you to trade any time during market hours. Mutual funds can only be bought or sold at the close of trading.

Both can diversify your portfolio, but ETFs tend to be more liquid and cheaper.

Conclusion

Mutual funds offer an easy way for beginners to get into investing without needing to know everything about the stock market. They provide diversification, professional management, and accessibility, making them a solid choice for anyone looking to grow their money over time.

Whether you’re starting with $100 or $10,000, there’s a mutual fund for you. So, take the plunge, do your research, and let mutual funds help you reach your financial goals!

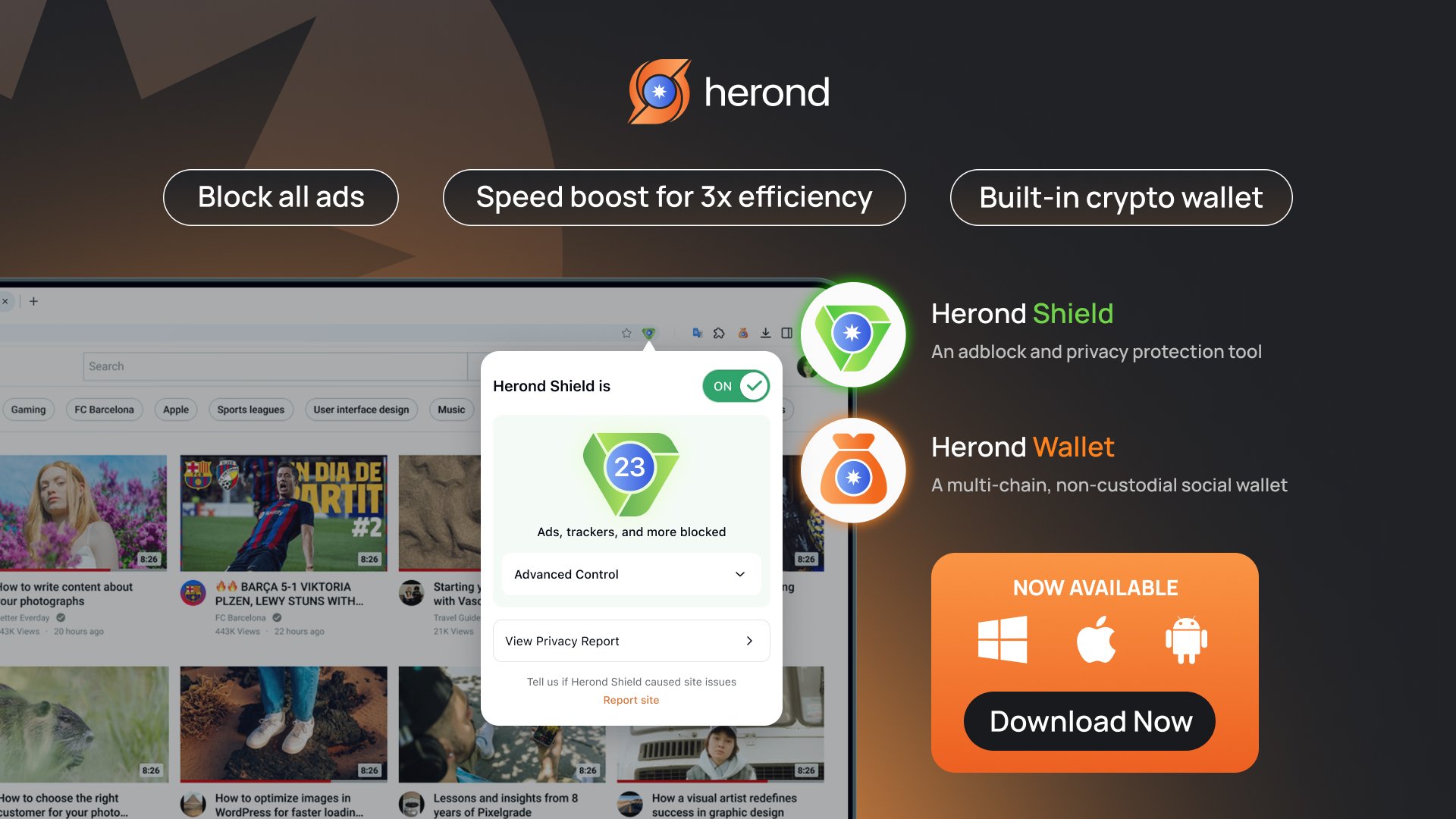

About Herond Browser

Herond Browser is a cutting-edge Web 3.0 browser designed to prioritize user privacy and security. By blocking intrusive ads, harmful trackers, and profiling cookies, Herond creates a safer and faster browsing experience while minimizing data consumption.

To enhance user control over their digital presence, Herond offers two essential tools:

- Herond Shield: A robust adblocker and privacy protection suite.

- Herond Wallet: A secure, multi-chain, non-custodial social wallet.

As a pioneering Web 2.5 solution, Herond is paving the way for mass Web 3.0 adoption by providing a seamless transition for users while upholding the core principles of decentralization and user ownership.

Have any questions or suggestions? Contact us:

- On Telegram https://t.me/herond_browser

- DM our official X @HerondBrowser

- Technical support topic on https://community.herond.org