The world of investing can be overwhelming, especially with so many options and complex strategies out there. If you’re looking for an easier way to get started, mutual funds might just be your ticket to smarter investing. So, what is mutual fund? and how can it help you build wealth? Don’t worry – we’ve got you covered. Let’s break it down in a way that’s simple, clear, and packed with the information you need to get started.

Learn more: Understanding Mutual Funds: A Simple Explanation

What is a Mutual Fund?

Simply put, a mutual fund is a pool of money from various investors that is used to invest in a range of assets, such as stocks, bonds, and other securities. Think of it like a big investment basket, where everyone contributes, and a professional fund manager makes the decisions on what goes in and out of that basket.

Why is this so popular? Because a mutual fund gives you access to a diversified investment portfolio without the need to manage it all by yourself. Whether you’re a beginner or just don’t have the time to dive into the stock market, mutual funds are a great option to get you started.

Learn more: Citron Research: Top Stock Analysis Reports 2025

How Do Mutual Funds Work?

When you invest in a mutual fund, you buy shares of that fund. Your money, along with money from other investors, is pooled together and managed by a professional fund manager. The fund manager chooses where to invest based on the fund’s strategy, whether that’s in stocks, bonds, or other types of assets.

The cool part? You don’t have to worry about managing each individual investment. The manager handles that for you, so you can sit back and let the professionals work. The value of your investment will change daily based on the performance of the assets in the fund — this is called the Net Asset Value (NAV).

5 Common Types of Mutual Funds

Not all mutual funds are created equal, so here’s a breakdown of the five most common types of funds you can consider:

- Stock Funds (Equity Funds): These funds mainly focus on stocks. They can be further divided into growth funds, value funds, and blend funds, each with its own risk and return potential.

- Bond Funds: These funds invest in bonds, offering more stable income and less risk compared to stocks. They’re a solid choice for conservative investors.

- Money Market Funds: Low-risk funds that invest in short-term debt like government securities. If you’re looking for stability and a safer bet, this is your go-to.

- Index Funds: Index funds aim to replicate the performance of a particular market index, like the S&P 500. These funds generally come with lower fees since they’re passively managed.

- Target-Date Funds: Designed for retirement savings, these funds automatically adjust their asset mix as you get closer to your target retirement date. It’s like setting your investment on autopilot.

5 Key Benefits of Investing in Mutual Funds

Making smart investment choices is crucial, but mutual funds offer a simple way to do so. Here’s why they stand out:

1. Diversification: One of the biggest advantages of mutual funds is that they provide instant diversification. Instead of putting all your money into one stock or bond, you invest in a pool of assets. This reduces the risk of losing everything if one investment doesn’t perform well.

2. Professional Management: You don’t need to be a financial expert to invest in mutual funds. The funds are managed by professionals who make informed investment decisions on your behalf. This saves you time and removes the stress of daily market monitoring.

3. Liquidity: Mutual funds provide flexibility when it comes to buying and selling. Unlike some investments, where you may need to wait for the right time or sell at a loss, mutual funds allow you to sell your shares on any business day.

4. Cost-Effective: Managing your own portfolio of stocks can be expensive, with high transaction fees for each trade. With mutual funds, you pay lower fees, and there’s no need to pay for every buy or sell, making them an affordable option.

5. Accessibility: Mutual funds are easy to get started with and don’t require large sums of money to invest. They’re great for beginners and allow you to start investing with a smaller amount compared to buying individual stocks.

4 Common Risks Investing in Mutual Funds

While mutual funds offer a range of benefits, it’s important to recognize the risks involved. Here are four risks to consider before diving in:

1. Market Risk: Mutual funds are subject to market fluctuations, just like any other investment tied to the stock or bond markets. If the market drops, the value of your fund could follow suit. Even though mutual funds often offer diversification, they can’t fully shield you from broader market downturns, and you might face losses during times of economic instability.

2. Liquidity Risk: While most mutual funds are relatively liquid, certain types—such as bond funds—may take longer to sell, especially during volatile periods. This could be an issue if you need quick access to your money. If the market is down, selling your shares could mean accepting a lower value, which could delay your ability to cash out at a favorable price.

3. Expense Risk: Many mutual funds come with management fees and other costs. These fees, known as the expense ratio, can eat into your returns over time. It’s important to carefully review the expense ratio before committing to a mutual fund, as high fees can significantly impact your long-term growth, especially with actively managed funds.

4. Manager Risk: A mutual fund’s success largely depends on the expertise and decisions of its manager. If the manager makes poor investment choices, the fund’s performance may suffer. Even a well-established fund could experience setbacks if the manager’s strategy doesn’t align with market conditions.

Understanding these risks is key to making informed decisions when investing in mutual funds.

4 Expert Tips on How to Choose the Right Mutual Fund

Choosing the right mutual fund can feel overwhelming, but it doesn’t have to be if you follow these expert tips on how to invest in mutual funds effectively:

Know Your Investment Goals

Before diving into mutual funds, it’s crucial to define your investment objectives. Are you looking for long-term growth, such as saving for retirement? Or are you aiming for short-term gains? Your goals will determine which type of mutual fund suits you best. For example, a growth fund might be ideal for long-term investors, while money market funds might be more suitable for those seeking stability and liquidity.

Consider Risk vs. Reward

Every mutual fund carries a certain level of risk. Some funds, like equity funds, are more volatile and have the potential for higher returns. On the other hand, bond funds and money market funds are typically safer but offer lower returns. Assess your risk tolerance and align it with your investment strategy to ensure you’re comfortable with the potential ups and downs.

Look at Fees

Fees can significantly impact your returns over time, especially with actively managed funds. Expense ratios can vary widely, so always check them before investing. Funds with lower fees are often more favorable unless a higher fee is justified by strong performance. Remember, low-cost funds like index funds might be a great option if you want to keep costs down.

Do Your Research

Don’t blindly pick a mutual fund. Always review the fund’s performance history, including how it has performed under different market conditions. This will give you insight into how well the fund is managed and how it reacts during periods of volatility. By doing your homework, you can choose a fund that aligns with your financial goals and risk tolerance.

With these expert tips, you’ll be well-equipped to make informed decisions on how to invest in mutual funds and choose the one that’s right for you.

Conclusion

So, what is a mutual fund? It’s a great way to get started with investing, whether you’re a beginner or a seasoned investor. Mutual funds offer diversification, professional management, and flexibility, making them a solid choice for many. Of course, like any investment, there are risks involved. But with the right knowledge and strategy, you can make mutual funds work for you. Whether you’re just starting or looking to expand your portfolio, mutual funds are an excellent option for building wealth.

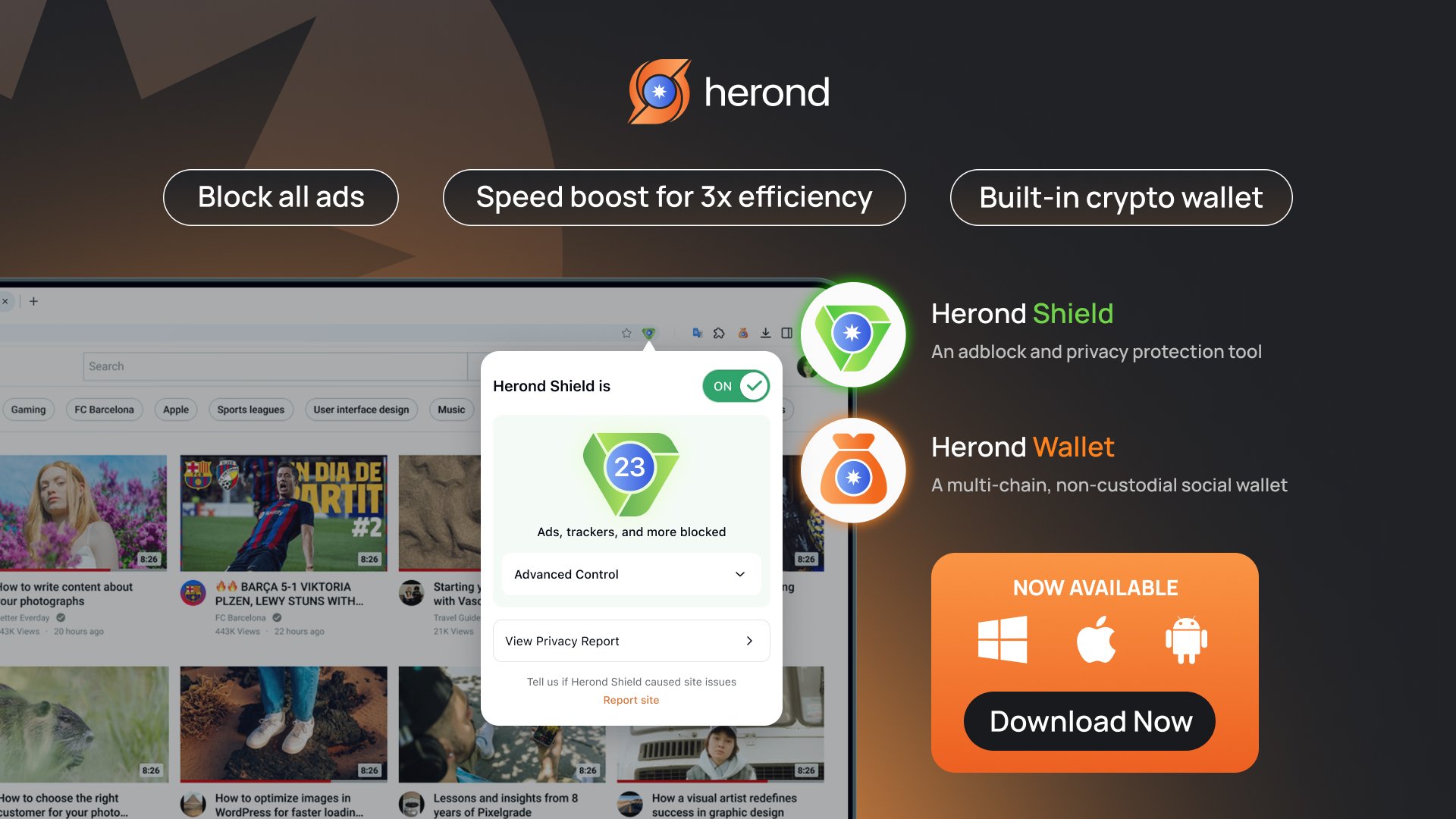

About Herond Browser

Herond Browser is a cutting-edge Web 3.0 browser designed to prioritize user privacy and security. By blocking intrusive ads, harmful trackers, and profiling cookies, Herond creates a safer and faster browsing experience while minimizing data consumption.

To enhance user control over their digital presence, Herond offers two essential tools:

- Herond Shield: A robust adblocker and privacy protection suite.

- Herond Wallet: A secure, multi-chain, non-custodial social wallet.

As a pioneering Web 2.5 solution, Herond is paving the way for mass Web 3.0 adoption by providing a seamless transition for users while upholding the core principles of decentralization and user ownership.

Have any questions or suggestions? Contact us:

- On Telegram https://t.me/herond_browser

- DM our official X @HerondBrowser

- Technical support topic on https://community.herond.org