In the world of cryptocurrency, to be successful in investment, it is greatly vital for our activeness in conducting careful research to gain enough insights and understanding for decision making. This kind of principle is called Doing Your Own Business (DYOR).

DYOR is crucial for navigating the cryptocurrency market, mitigating risks, making informed decisions, and building confidence as an investor. It fosters a culture of responsibility, critical thinking, and self-reliance, ultimately leading to better investment outcomes and long-term success.

This article will introduce to you the definition and benefits of Doing Your Own Research (DYOR). Moreover, to effectively apply this principle, we also define a detailed Step-By-Step guide on DYOR.

What is Doing Your Own Research (DYOR)?

DYOR, short for “Doing Your Own Research”, is a fundamental principle in investing and trading in the cryptocurrency market. Literally, it refers to the process of conducting thorough research and due diligence to gather information, assess risks, and make informed decisions before investing in a particular asset or project.

Benefits of Doing Your Own Research (DYOR)

DYOR (Do Your Own Research) is crucial for investors and traders in the cryptocurrency market for several reasons as below.

Minimizing Risk

DYOR helps investors identify potential risks associated with cryptocurrency investments. In more detail, by understanding project fundamentals, market dynamics, and regulatory considerations, investors can make more informed decisions and mitigate risks.

Avoiding Scams and Frauds

It is common that the cryptocurrency market is susceptible to scams, frauds, and fraudulent projects. Therefore, DYOR is a good method for investors to identify red flags. For example, we can spot lack of transparency, dubious team credentials, unrealistic promises, and Ponzi schemes, and avoid falling victim to fraudulent schemes.

Understanding Project Fundamentals

DYOR allows investors to gain a comprehensive understanding of cryptocurrency projects, including their technology, use cases, team, roadmap, and tokenomics. In other words, by evaluating project fundamentals, investors can assess the viability, potential, and long-term prospects of different projects.

Making Informed Decisions

By conducting independent research, investors can make informed decisions based on facts, data, and analysis rather than relying solely on speculation or herd mentality. DYOR empowers investors to assess the risks and rewards of cryptocurrency investments and make decisions aligned with their investment goals and risk tolerance.

Building Confidence and Conviction

DYOR builds confidence and conviction in investment decisions by providing investors with a deeper understanding of the cryptocurrency market and individual projects. To explain, by thoroughly researching projects and market trends, investors can develop confidence in their investment thesis and navigate market volatility with conviction.

Staying Updated and Informed

The cryptocurrency market is dynamic and constantly evolving, with new projects, technologies, and market trends emerging regularly. DYOR helps investors stay updated and informed about the latest developments, news, and trends in the cryptocurrency ecosystem, enabling them to adapt their investment strategies accordingly.

Avoiding FOMO (Fear of Missing Out)

FOMO can lead investors to make impulsive decisions based on hype or short-term price movements, often resulting in losses. DYOR helps investors avoid FOMO by providing a rational and disciplined approach to investment decision-making, grounded in research, analysis, and understanding.

Empowering Investors

DYOR empowers investors to take control of their investment decisions and become more self-reliant. By conducting independent research and analysis, investors can rely on their own judgment rather than blindly following others’ recommendations or advice, leading to better outcomes and financial independence.

Doing Your Own Research (DYOR): A Step-By-Step Guide

Here’s a beginner’s guide to do your own research (DYOR) in cryptocurrency:

Step 1: Understand the Basics

To start, you should learn about every fundamental aspect of cryptocurrency and terminology. For example, blockchain technology, decentralized finance (DeFi), smart contracts, tokens, and digital wallets.

Step 2: Research Cryptocurrency Projects

After that, you should research different cryptocurrency projects and review project whitepapers to understand their goals, use cases, technology, team, and development roadmap. Besides, it is much more important to assess the project’s development roadmap to understand its progress, milestones, and future plans.

Step 3: Evaluate Technology and Use Cases

In this step, you should evaluate the underlying technology of cryptocurrency projects, including scalability, security, consensus mechanisms, and interoperability. Moreover, spending time identifying the real-world problems that the cryptocurrency project aims to solve and assess its potential impact and relevance is also important.

Step 4: Review Team and Development

Next, research the background and experience of the project team, especially in terms of transparency and credibility. For instance, developers, advisors, and founders.

Step 5: Analyze Market and Competition

You should analyze the cryptocurrency market trends and competitive landscape by researching similar projects and assessing their market positioning. The metrics can include price movements, trading volume, market capitalization, and overall market sentiment.

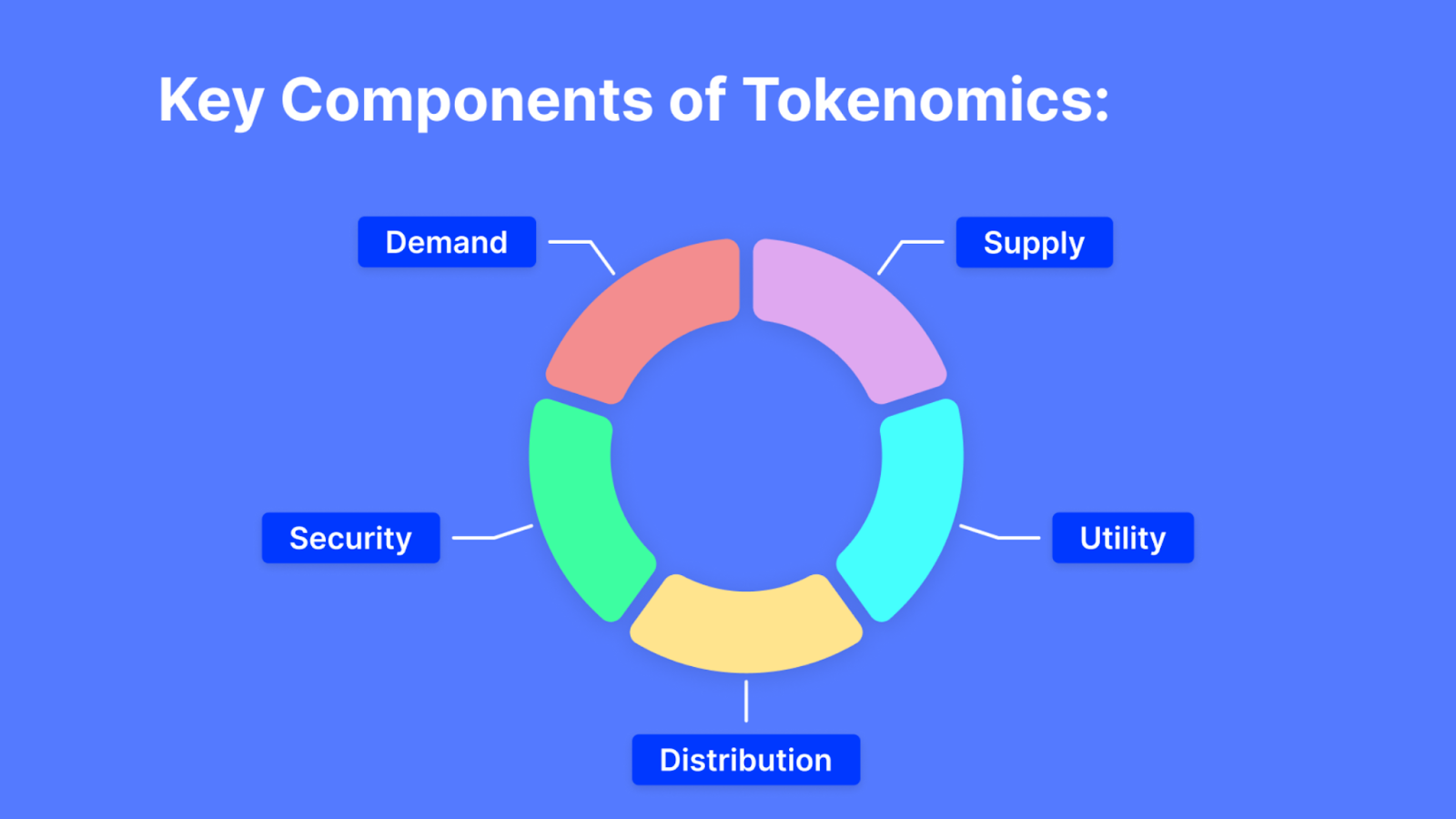

Step 6: Consider Tokenomics and Economics

It is vital to consider tokenomics and economic models. In more detail, you should assess token distribution, supply dynamics, inflation rate, and utility within the ecosystem.

Step 7: Evaluate Risks and Challenges

Evaluating potential risks and challenges include regulatory uncertainty, technological vulnerabilities, competition, and market volatility. Then, develop strategies to mitigate risks such as diversification or setting stop-loss orders.

Step 8: Stay Informed and Updated

It is vital to always get updated with the latest developments, trends, and news. The potential resources must be reliable such as blogs, forums, and social media channels.

Step 9: Exercise Caution and Due Diligence

After getting all the information, we should conduct careful verification to prevent unverified sources or rumors.

Step 10: Start Small and Diversify

Start with small investments and gradually increase your exposure to different cryptocurrencies as you gain experience and confidence. Then, diversify your cryptocurrency portfolio across different projects, sectors, and asset classes to mitigate risk and maximize potential returns.

By following these steps and conducting thorough research, beginners can make more informed decisions and navigate the cryptocurrency market with greater confidence.

Conclusion

To sum up, in the context of cryptocurrency, where the market is highly speculative and volatile, DYOR is essential for investors to protect themselves from scams, frauds, and risky investments. It involves exploring various aspects of a cryptocurrency project or asset to gain a comprehensive understanding of its technology, team, use cases, market potential, risks, and overall credibility.

Moreover, remember that investing in cryptocurrency involves inherent risks, and it is essential to do your own research and exercise caution at all times.

About Herond Browser

Herond Browser is a Web browser that prioritizes users’ privacy by blocking ads and cookie trackers, while offering fast browsing speed and low bandwidth

consumption. Herond Browser features two built-in key products:

- Herond Shield: an adblock and privacy protection tool;

- Herond Wallet: a multi-chain, non-custodial social wallet.

Herond aims at becoming the ultimate Web 2.5 solution that sets the ground to further accelerate the growth of Web 3.0, heading towards the future of mass adoption.

Join our Community!