Citron Research is back with new stock reports for 2025. Their calls have always sparked debates. Some stocks soared, others collapsed. This year, they are eyeing undervalued stocks, market trends, and risky investments. Investors want to know: Should you follow their insights or stay cautious?

Learn more: How to get low funding rates on perpetual crypto

What is Citron Research?

Citron Research is not like traditional financial firms. They don’t just analyze stocks—they challenge the market’s beliefs. Their reports often expose overhyped companies while revealing hidden investment opportunities.

Andrew Left, Citron’s founder, has built a reputation for bold stock predictions. He famously shorted Tesla when it was still rising. He exposed fraud in Luckin Coffee before it collapsed. Some of his calls changed the way investors looked at entire industries.

But Citron has also made mistakes. They bet against Nvidia early and lost. They underestimated Shopify’s growth. Their stock market analysis is controversial, but one thing is certain—people listen to them.

Learn more: What is Swap? How Swaps Work in Finance

2025 Stock Trends: What Citron Sees Coming

In 2025, Citron Research has identified significant shifts across major industries, forecasting a transformative year for investors.

AI Stocks: Navigating Hype and Reality

Citron cautions that while artificial intelligence (AI) remains a burgeoning field, certain companies may be overvalued due to speculative investments rather than solid financial performance. A notable example is Rigetti Computing, a quantum-computing firm that experienced a dramatic stock surge, only to face sharp declines after Citron labeled the rise as “ridiculous,” highlighting the risks of hype-driven valuations.

Conversely, Citron has spotlighted Nebius Group NV as an under-the-radar AI opportunity. Backed by industry giants like Nvidia, Nebius has been recognized for its potential to become a significant player in the AI infrastructure sector, with Citron suggesting a valuation that could position its stock price around $60.

Healthcare Stocks: Poised for Growth

The healthcare sector is undergoing rapid transformation, driven by technological advancements and an aging global population. Citron has identified Teladoc Health as a company leveraging AI to enhance its telemedicine services. Despite past perceptions as a “pandemic relic,” Teladoc’s strategic use of technology has improved profitability, making it an attractive acquisition target for major corporations like Amazon or CVS.

Additionally, industry experts predict that AI-powered diagnostics and personalized medicine will become more prevalent, offering investment opportunities in companies at the forefront of these innovations.

Energy Stocks: Traditional Players Reemerging

While renewable energy continues its ascent, Citron’s analysis suggests a potential resurgence in traditional oil and gas companies. Factors such as geopolitical developments and economic policies could drive demand for conventional energy sources. For instance, Talen Energy has been identified as a company to watch, with a market capitalization of $10 billion and potential for growth in the AI-energy nexus.

In summary, Citron Research’s 2025 outlook emphasizes the importance of discerning genuine innovation from market hype, particularly in the AI sector, recognizing growth potential in healthcare through technological integration, and acknowledging the possible resurgence of traditional energy companies amidst evolving market dynamics.

Best Stock Picks for 2025 According to Citron

Citron has identified several stocks that they believe are undervalued gems. These companies have strong fundamentals, rising profits, and untapped potential.

- A hidden AI stock: While big names like Nvidia and OpenAI dominate headlines, Citron has spotted a smaller AI company flying under the radar. They believe this stock could deliver massive returns.

- A biotech company with breakthrough technology: Citron’s analysts argue that one specific healthcare stock has potential for a major breakout in 2025.

- An oil and gas stock with untapped reserves: While many investors are chasing renewables, Citron believes one traditional energy company is positioned for a comeback.

They claim these stocks have high-profit potential, but as always, investors should do their own research.

Citron’s Most Controversial Calls This Year

Citron Research continues to stir controversy with their bold predictions. In 2025, some of their most contentious calls could significantly affect the stock market if proven accurate.

- An AI Company Doomed to Fail: Citron has singled out a major AI stock, claiming that it is overhyped and purely speculative. With the recent surge in AI investments, Citron argues that the stock lacks a solid financial foundation and will face a sharp decline. Investors holding this stock might be exposed to huge losses if the company fails to deliver on its promises. The stock in question has seen speculative growth, driven by the AI boom, but with no profitable business model to support the hype.

- A Tech Stock Running on Borrowed Time: Citron has identified a leading tech company that they believe is nearing its end. Their research suggests that this stock is at risk of a major collapse within the next year, due to declining innovation and market competition. Citron’s track record with tech predictions has been mixed, but if correct, this prediction could shock the tech market.

- A Financial Stock Hiding Major Risks: Citron also warns that a prominent financial services company is covering up serious risks. According to their report, this company has hidden financial vulnerabilities that could collapse under market pressure. This could lead to massive losses for investors if the company’s true financial health comes to light.

Despite the backlash and skepticism from critics who view Citron’s calls as too aggressive, history shows that their controversial predictions have been right before—like when they warned about Luckin Coffee’s fraud, causing investors to avoid significant losses.

The Risks and Rewards of Following Citron Research

Citron Research has had a notable impact on investors, both positively and negatively. Their bold calls have created huge rewards but also significant risks.

- The Rewards: Citron has made a name by spotting hidden gems before the broader market catches on. For example, they were early to identify Nvidia’s AI potential, a stock that has seen massive gains. Citron also warns about overvalued stocks. Their call on Luckin Coffee, when it was accused of fraud, saved investors from major losses. Their deep financial analysis often uncovers opportunities overlooked by mainstream analysts. In 2025, Citron’s focus on undervalued healthcare and energy stocks presents fresh opportunities, such as Teladoc Health and Talen Energy.

- The Risks: However, Citron has made some wrong calls as well. They famously bet against Tesla before its massive rise. Also, shorting stocks – betting on their decline—can be dangerous, especially when stocks defy predictions, as seen with their failed bets on Shopify.

Conclusion

Citron Research has once again delivered bold, controversial insights into the stock market. Some investors trust them completely, while others see them as too aggressive. If Citron is right, some stocks will skyrocket, while others will crash. If they are wrong, their predictions could lead to bad investment decisions. The real question is: Will you take their advice or bet against them?

Learn more: Understanding Mutual Funds: A Simple Explanation

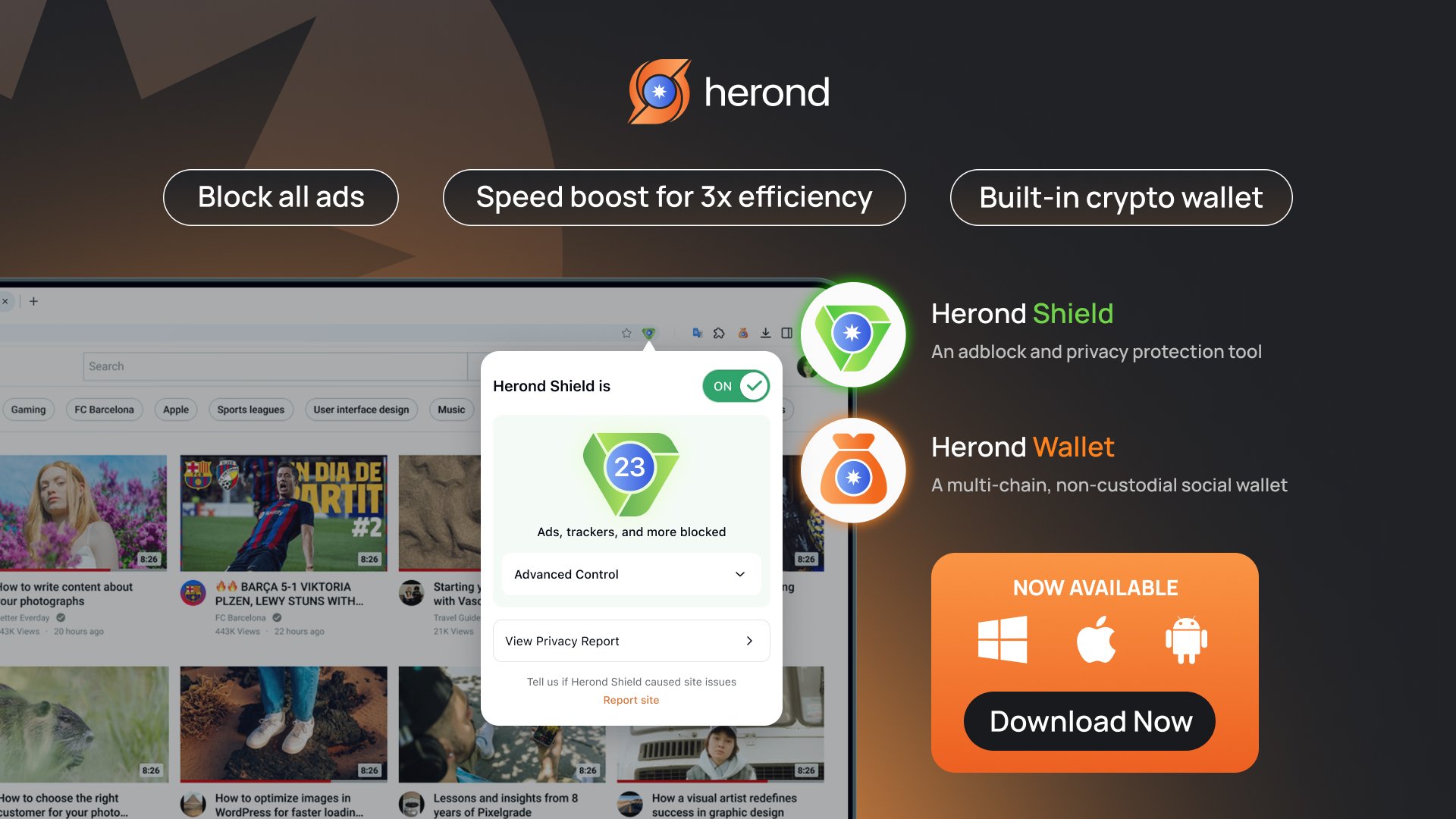

About Herond Browser

Herond Browser is a cutting-edge Web 3.0 browser designed to prioritize user privacy and security. By blocking intrusive ads, harmful trackers, and profiling cookies, Herond creates a safer and faster browsing experience while minimizing data consumption.

To enhance user control over their digital presence, Herond offers two essential tools:

- Herond Shield: A robust adblocker and privacy protection suite.

- Herond Wallet: A secure, multi-chain, non-custodial social wallet.

As a pioneering Web 2.5 solution, Herond is paving the way for mass Web 3.0 adoption by providing a seamless transition for users while upholding the core principles of decentralization and user ownership.

Have any questions or suggestions? Contact us:

- On Telegram https://t.me/herond_browser

- DM our official X @HerondBrowser

- Technical support topic on https://community.herond.org