In 2026, crypto is no longer just for holding-it’s for building. Staking, especially Coinbase Staking has become the essential strategy for turning idle assets into a productive income stream.

While the technical side of blockchain can be daunting, Coinbase has simplified the process into a few clicks, making it the premier gateway for users to earn rewards on assets like ETH, SOL, and ADA without managing complex hardware.

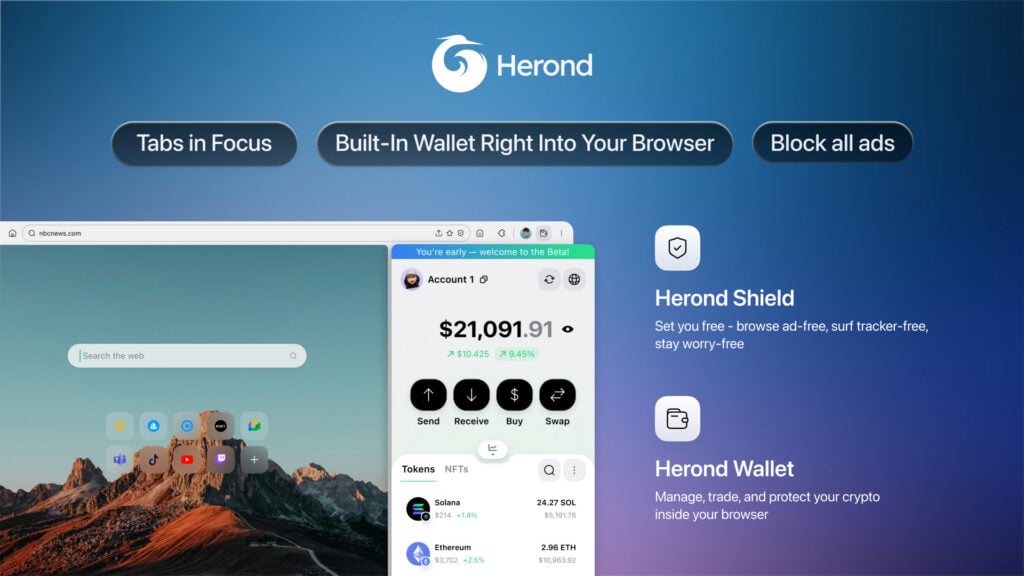

This guide provides a short, step-by-step tutorial to help you master Coinbase staking. Also, it helps to maximize your yields, and understand how it fits into your broader Web3 journey with Herond.

What is Coinbase Staking? (Foundational Knowledge)

Understanding the Power of Staking

At its core, staking is the process of “locking up” your digital assets to act as collateral for a blockchain’s security and operations. In a Proof-of-Stake (PoS) system, the network relies on these committed funds rather than energy-hungry hardware to verify transactions. By participating, you aren’t just letting your crypto sit idle; you are actively contributing to the integrity of the ecosystem. In exchange for this commitment, the network grants you staking rewards, essentially allowing your crypto to earn a yield similar to interest in a high-yield savings account.

The “Middleman” Advantage: Lowering the Barrier

One of the most significant hurdles to solo staking is the high technical and financial requirement—for instance, staking Ethereum independently typically requires a staggering 32 ETH and the expertise to run a dedicated validator node 24/7. This is where the “Middleman” Advantage of Coinbase shines. By pooling user funds together, Coinbase democratizes access, allowing you to start earning rewards with as little as $1. They handle the complex backend responsibilities, from maintaining hardware to meeting validator thresholds, so you can enjoy the benefits of professional-grade staking without the overhead or the steep entry costs.

Why Stake on Coinbase? (Pros & Cons)

Deciding where to stake your assets is a balance between convenience and control. For many Web3 newcomers, Coinbase offers a compelling entry point with several key advantages:

The Pros: Why it’s the Go-To for Beginners

- One-Click Ease of Use: Forget about managing complex validator nodes or hardware. Coinbase turns staking into a seamless “one-click” experience directly from your portfolio.

- Ultra-Low Barriers to Entry: While independent staking (like Ethereum) often requires a massive upfront investment, Coinbase allows you to start earning rewards with as little as $1, making passive income accessible to everyone.

- cbETH & Liquid Staking: To solve the problem of “frozen” assets, Coinbase offers cbETH (Coinbase Wrapped Staked ETH). This utility token allows you to maintain liquidity, meaning you can trade, sell, or use your stake position in DeFi apps without waiting for long unstaking periods.

- Institutional-Grade Security: As a regulated, publicly-traded company, Coinbase provides a layer of trust and “slashing protection” that mitigates the technical risks often found in smaller staking pools.

The Cons: What to Keep in Mind

- Commission Fees: Convenience comes at a price. Coinbase typically takes a commission (around 25 – 35%) on the rewards earned, which is higher than many decentralized alternatives.

- Custodial Trade-offs: When staking on an exchange, you are not in direct control of your private keys. For those who prioritize the “Self-Custody” ethos of Herond, this remains a significant consideration.

- Centralization Risk: Relying on a single platform means your rewards and access are subject to the exchange’s specific terms, regional regulations, and platform uptime.

Step-by-Step Tutorial: How to Stake on Coinbase

- Step 1: Account Setup & Verification: Ensure your ID verification is current (E-E-A-T requirement).

- Step 2: Funding Your Wallet: Buying eligible assets or transferring them from an external wallet.

- Step 3: Navigating to “Earn”: Locating the staking hub within the 2026 Coinbase UI.

- Step 4: Selecting Your Asset: Comparing current APYs and lock-up periods.

- Step 5: Confirming the Stake: Understanding the “Bonding Period” (the wait time before rewards start).

Managing Your Staked Assets

- Tracking Rewards: Monitor your growth in real-time via the “My Assets” tab. View daily accrued earnings and total payouts directly in the app to see your passive income in action.

- The Unstaking Process: Moving assets out of staking isn’t instant due to “Unbonding Periods.” In 2026, expect Ethereum (ETH) to take several days to weeks depending on the queue, while Solana (SOL) typically finishes in 2 – 4 days.

- Tax Considerations: Staking rewards are treated as taxable income. Coinbase will issue a 1099-MISC form if you earn over $600 in a tax year, making it essential to keep accurate records for your annual filing.

Risks You Need to Know

While Coinbase makes earning simple, staying aware of these three key risks is essential for a smart strategy:

- Slashing & Validator Integrity: Slashing is a network penalty where a portion of your crypto is confiscated if a validator misbehaves (e.g., goes offline or double-signs). The Coinbase Advantage: Coinbase provides a slashing protection guarantee, meaning they typically cover any losses caused by their own validator errors, ensuring your principal remains safe.

- Locked Liquidity vs. Market Volatility: When you stake, your assets are often “locked” during an unbonding period. If the market price drops significantly while your assets are locked, you won’t be able to sell immediately to cut losses. Herond Tip: Consider using liquid staking options like cbETH to maintain the ability to trade even while earning rewards.

- Protocol & Roadmap Evolution: Blockchains are constantly upgrading. For instance, Ethereum’s 2026 upgrades (like Glamsterdam and Hegota) focus on decentralization and security, which can lead to shifting APY rates or new lock-up rules. Staying updated on these protocol changes is vital to predicting your long-term yield.

The Herond Perspective: Moving Toward Self-Custody

As a Marketing Specialist at Herond, I have drafted the final sections of your guide to highlight why staking is the ultimate bridge to the future of Web3.

The Bridge: From Beginner to Power User

While Coinbase is an excellent entry point for your first reward, the true spirit of Web3 lies in Self-Custody. As you grow more comfortable with the ecosystem, transitioning to a decentralized solution like Herond Wallet offers several key advantages:

- Maximum Transparency & Control: Unlike the “black box” of centralized exchanges, decentralized staking happens directly on-chain. With Herond Wallet, you aren’t just a spectator; you hold your own private keys and interact directly with blockchain protocols.

- Higher Yield Potential: By removing the “middleman” commission fees (which can be as high as 25-35% on exchanges), you often keep a larger share of the network rewards for yourself.

- Composability in DeFi: Once you move your assets to Herond, your stacked tokens often become “Liquid.” You can use these assets as collateral in other DeFi apps to earn extra yield, a level of flexibility that centralized platforms rarely provide.

Mass Adoption: Staking as the “Gateway Drug”

In 2026, staking became the primary driver for bringing the next billion users into the Web3 ecosystem. It transforms the user experience from speculative trading to active participation:

- Lowered Psychological Barriers: Earning “passive income” is a concept everyone understands. By offering a familiar reward structure similar to a savings account, staking makes the complex world of blockchain feel accessible and rewarding.

- Retention and Education: Staking encourages long-term thinking. As users track their daily payouts, they naturally begin to learn about network health, validator choices, and governance, turning casual observers into informed community members.

- A Unified Web3 Experience: Because staking creates a reason to keep assets in a wallet, it naturally leads users to explore dApp browsers, cross-chain bridges, and NFT marketplaces. It is the “first step” that opens the door to the entire decentralized economy.

Conclusion

Staking on Coinbase remains one of the most effective ways to transition from a casual observer to an active participant in the 2026 digital economy. By lowering technical barriers and offering institutional-grade security, Coinbase has made it possible for anyone to turn a stagnant portfolio into a productive, yield-generating engine with just a few clicks.

However, as you’ve seen in this guide, the “convenience” of exchange staking is only the first step. While it provides an excellent foundation, the ultimate goal for any Web3 user is to move toward higher yields, greater transparency, and total control over their private keys.