When discovering cryptocurrency exchanges, you should care about the “Order Book” term. Literally, order books are fundamental components of financial markets, particularly in electronic trading systems. The reason for the aforementioned statement is that they represent the dynamic list of buy and sell orders for a particular asset (such as stocks, cryptocurrencies, or commodities) at different prices.

So, are you curious about the detailed definition of order books? Also, it is essential to explore many different classifications of order books, which helps to enable us to take the full advantages of them and gain the most profits. Now, let’s dive in!

What is an Order Book?

An order book is a real-time record of buy and sell orders for a particular financial instrument, such as stocks, cryptocurrencies, or commodities. Literally, it displays the current market depth and liquidity by listing all active buy and sell orders, along with their respective prices and quantities.

Key Components of Crypto Order Book

The key components of an order book in financial markets include:

Bid Orders

These are buy orders placed by traders indicating the price and quantity at which they are willing to purchase an asset. Bid orders are listed on the bid side of the order book, with the highest bid price typically at the top.

Ask Orders

Also known as sell orders, these are orders placed by traders indicating the price and quantity at which they are willing to sell an asset. Ask orders are listed on the ask side of the order book, with the lowest ask price typically at the top.

Price Levels

Each order in the order book is associated with a specific price level, representing the price at which traders are willing to transact. Price levels are arranged in descending order on the bid side and ascending order on the ask side.

Quantity

This refers to the number of units of the asset being offered or sought at a particular price level. Each bid and ask order in the order book specifies the quantity of the asset that the trader intends to buy or sell.

Market Depth

Market depth refers to the total volume of buy and sell orders at each price level in the order book. Traders use market depth to assess the level of liquidity available in the market and the potential impact of their trades on the asset’s price.

Spread

The spread is the difference between the highest bid price and the lowest ask price in the order book. It represents the cost of executing a trade and provides insights into the current market conditions and trading activity.

Order Types

The order book may contain various types of orders, including market orders, limit orders, stop orders, and more. Each order type has specific instructions for execution, such as buying or selling at the current market price or a specified price level.

Time and Sales Data

Some order books may include time and sales data, which records the time, price, and quantity of each executed trade. This information helps traders track market activity and analyze price movements over time.

Classifications of Order Book

There are several types of order books commonly used in crypto trading platforms, each serving specific trading needs and preferences. Here are the main types:

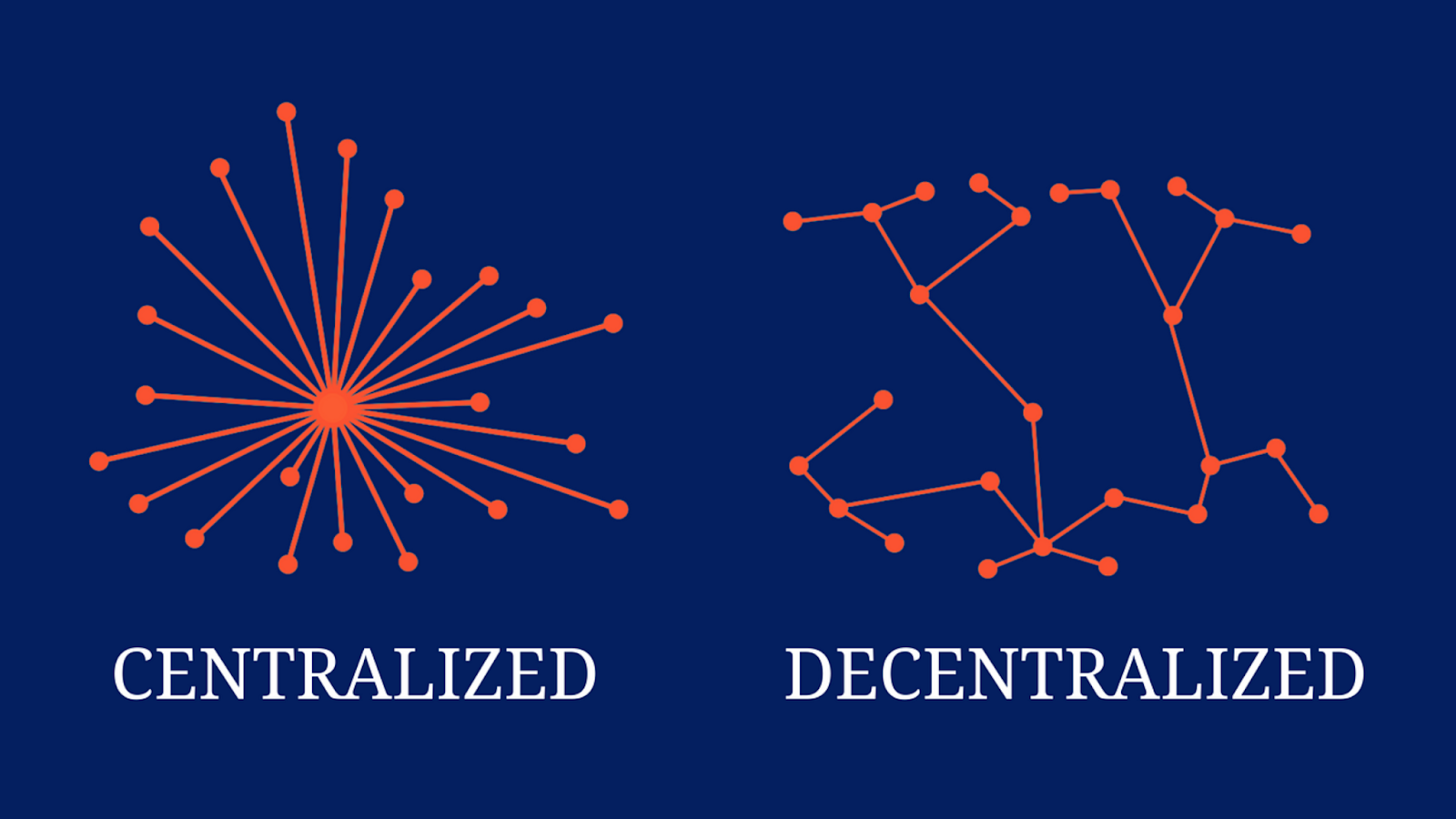

Centralized Exchange Order Book

Centralized cryptocurrency exchanges host and manage their order books on their platforms. These order books display buy and sell orders from users trading various cryptocurrencies against each other or fiat currencies. Examples of centralized exchanges with order books include Binance, Coinbase, and Kraken.

Decentralized Exchange (DEX) Order Book

Decentralized exchanges operate without a central authority, and their order books are distributed across a decentralized network of nodes. DEX order books enable peer-to-peer trading of cryptocurrencies directly between users, without the need for intermediaries. Examples of decentralized exchanges with order books include Uniswap, SushiSwap, and PancakeSwap.

Spot Trading Order Book

Spot trading order books facilitate the trading of cryptocurrencies at the current market price (spot price). Users can place market orders or limit orders specifying the desired price and quantity. This type is prevalent in both centralized and decentralized exchanges for trading various crypto assets.

Perpetual Swap Order Book

Perpetual swaps are a type of derivative contract commonly traded on cryptocurrency exchanges. Perpetual swap order books display buy and sell orders for these perpetual contracts, which enable traders to speculate on the future price of cryptocurrencies without an expiration date.

Futures and Derivatives Order Book

Some cryptocurrency exchanges offer futures and derivatives trading, where users can trade contracts based on the future price of cryptocurrencies. Futures and derivatives order books display buy and sell orders for these derivative contracts, enabling traders to speculate on price movements and hedge their positions.

Margin Trading Order Book

Margin trading allows users to borrow funds from the exchange to amplify their trading positions. Margin trading order books display buy and sell orders for leveraged trading pairs, where users can trade with borrowed funds. These typically include features such as margin levels and liquidation prices to manage risk.

Decentralized Finance (DeFi) Order Book

DeFi platforms offer decentralized financial services such as lending, borrowing, and trading using smart contracts. DeFi order books enable trading of various financial instruments, including decentralized exchanges, liquidity pools, and decentralized lending protocols.

Conclusion

Overall, order book provides transparency and facilitate price discovery in financial markets by aggregating and displaying buy and sell orders from market participants. They are essential tools for traders, exchanges, and regulators in understanding market dynamics and ensuring fair and efficient trading.

Moreover, when understanding key functions of each type of order book, we can take the full advantage of it to get the most profits in cryptocurrency exchanges.

About Herond Browser

Herond Browser is a Web browser that prioritizes users’ privacy by blocking ads and cookie trackers, while offering fast browsing speed and low bandwidth consumption. Herond Browser features two built-in key products:

- Herond Shield: an adblock and privacy protection tool;

- Herond Wallet: a multi-chain, non-custodial social wallet.

Herond aims at becoming the ultimate Web 2.5 solution that sets the ground to further accelerate the growth of Web 3.0, heading towards the future of mass adoption.

Join our Community!