Talking about Crypto, have you ever been curious if there is any academic study on this topic? The answer is “Yes”. It is Tokenomics. Literally, Tokenomics is a good foundation to be applied in many areas of Cryptocurrency Investment because it can help us to analyze the insights and potential of crypto projects before making any decisions.

This article aims to give you a deeper insight about Tokenomics and discuss the way that investors can look into when investing and speculating.

What is Tokenomics?

Tokenomics, a portmanteau of “token” and “economics”, is the study and design of the economic systems underlying cryptocurrencies and digital tokens. In other words, it encompasses the various economic principles, mechanisms, and incentives that govern the creation, distribution, supply, demand, and utility of tokens within their respective ecosystems.

Most importantly, tokenomics plays a crucial role in shaping the behavior of participants within these ecosystems and influences factors such as token value, adoption, and sustainability.

Key Components of Tokenomics

These components are crucial for shaping the value, adoption, and sustainability of the token. Here are the primary components:

Token Issuance

This component involves the creation and distribution of tokens within the ecosystem. It includes determining the initial token supply, distribution methods (such as initial coin offerings, airdrops, or mining), and token release schedules.

Token Distribution

Token distribution refers to how tokens are allocated among stakeholders, including developers, investors, users, and ecosystem contributors. It aims to achieve a fair and equitable distribution while incentivizing participation and contribution.

Token Supply

Token supply encompasses the total number of tokens that exist within the ecosystem. It includes factors such as the maximum token supply cap, token burning mechanisms, inflationary or deflationary models, and emission schedules.

Token Utility

Token utility defines the various use cases and functions of the token within the ecosystem. This can include governance rights, access to platform services, payment for goods or services, participation in decentralized applications, or other utility functions.

Economic Incentives

Economic incentives are mechanisms designed to encourage desired behaviors and actions within the ecosystem. For instance, this includes rewards, staking incentives, yield farming opportunities, liquidity mining programs, or other incentive structures to encourage token holding and usage.

Governance and Decision-Making

Governance mechanisms enable token holders to participate in the decision-making processes of the ecosystem. This includes voting rights, proposal submission and voting mechanisms, and governance structures that allow token holders to influence protocol upgrades, parameter changes, or fund allocations.

Community Engagement

Community engagement initiatives aim to foster an active and supportive community around the token. This includes transparent communication, community events, educational resources, and incentive programs to encourage participation, collaboration, and advocacy.

Why Is Tokenomics Important When Investing in Cryptocurrency?

When investing in cryptocurrency, applying tokenomics is important for several reasons:

Provide Insights About Value Proposition

Tokenomics provides insight into the underlying value proposition of a cryptocurrency or token. In more detail, by analyzing the tokenomics’ components, investors can assess its potential for long-term value creation.

Help To Evaluate Investment Potential

Tokenomics helps investors evaluate the investment potential of a cryptocurrency. Factors such as token utility, scarcity, demand-supply, etc. can influence the token’s price appreciation potential and investment attractiveness.

Assess Token Adoption

Tokenomics provides information about the token’s adoption and usage within its ecosystem. By understanding the token’s utility and demand drivers, investors can assess its adoption potential and market penetration. Consequently, they can forecast the success of their long-term investment.

Mitigate Risks

Analyzing tokenomics can help investors identify potential risks associated with a cryptocurrency investment. Factors such as centralized token distribution, excessive token inflation, lack of utility, or weak economic incentives can pose risks to the token’s value and investment viability.

Reflect The Sustainability Of Projects

Comprehensive tokenomics models often reflect well-designed and sustainable cryptocurrency projects. By assessing factors such as governance mechanisms, community engagement, and economic incentives, investors can identify projects with robust fundamentals and long-term viability.

Common Pitfalls in Tokenomics

Sometimes it is essential to be aware when there are any red flags in tokenomics as follows.

Massive Pump and Dumps

These schemes involve artificially inflating the price of a token through coordinated buying (pumping) and then selling (dumping) at a profit, often leaving unsuspecting investors with losses. Such schemes are often orchestrated by groups aiming to manipulate the market for short-term gains. Therefore, disproportionate token allocations to early investors can lead to pump and dump schemes during pre-sales, harming newer investors.

Excessive Token Supply

Projects with an excessively large token supply, especially if there is no mechanism to control inflation, can dilute the value of existing tokens over time, leading to decreased investor confidence and long-term viability concerns.

Centralization of Ownership

When a significant portion of tokens is owned by a small group of individuals or entities, it can lead to centralized control and manipulation of the token’s price and ecosystem, undermining decentralization and governance principles.

Lack of Utility

Tokens without clear utility or use cases within their ecosystem may struggle to maintain value over time, as there’s little demand for holding or using them beyond speculative trading.

Weak Governance Mechanisms

Projects with inadequate governance structures or mechanisms for community participation may be susceptible to governance failures, disputes, or decisions that do not align with the best interests of the community.

Security Vulnerabilities

Smart contracts or platforms with security vulnerabilities can be exploited by attackers to steal funds or disrupt the ecosystem, leading to financial losses and reputational damage.

Opaque Tokenomics

Lack of transparency in tokenomics can erode trust and credibility, making investors wary of participating in the project. For example, undisclosed token allocations, unclear distribution plans, or hidden fees

Misaligned Incentives

Projects with economic incentives that primarily benefit insiders or early investors, without providing value to the broader community, may lead to conflicts of interest and distrust among stakeholders.

Regulatory Risks

Projects operating in regulatory gray areas or violating legal requirements may face enforcement actions, fines, or regulatory scrutiny, posing risks to their operations and long-term viability.

Poor Community Engagement

Projects that neglect to engage with their community, respond to feedback, or provide regular updates may struggle to build trust and loyalty, hindering their ability to attract and retain users and investors.

Conclusion

To sum up, tokenomics plays a crucial role in guiding investment decisions in cryptocurrency markets. By analyzing the economic fundamentals of a token, investors can make informed decisions, mitigate risks, and capitalize on opportunities for value creation and wealth accumulation in the evolving crypto landscape.

Moreover, besides analyzing based on the key components of tokenomics, it is necessary for investors to be highly aware of common pitfalls as listed above.

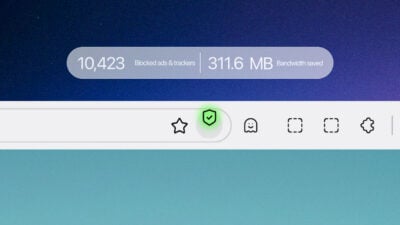

About Herond Browser

Herond Browser is a Web browser that prioritizes users’ privacy by blocking ads and cookie trackers, while offering fast browsing speed and low bandwidth consumption. Herond Browser features two built-in key products:

- Herond Shield: an adblock and privacy protection tool;

- Herond Wallet: a multi-chain, non-custodial social wallet.

Herond aims at becoming the ultimate Web 2.5 solution that sets the ground to further accelerate the growth of Web 3.0, heading towards the future of mass adoption.

Join our Community!