Since being introduced, cryptocurrencies have always been regarded as volatile investment instruments according to their price. Therefore, there arise many price jumps or conflicts, which eventually prevent cryptocurrencies from being used for daily activities due to high risks. Consequently, stablecoins are created for this issue. So what is actually “Stablecoin”? And what types of stablecoins are there? In this article, we will help you to answer these questions. Let’s dive in!

What is Stablecoin?

A stablecoin is a type of cryptocurrency that is designed to maintain a stable value by pegging it to a reserve of assets, such as fiat currencies (e.g., US dollars, euros), other cryptocurrencies, or commodities. The primary goal of stablecoins is to mitigate the price volatility often associated with traditional cryptocurrencies like Bitcoin and Ethereum.

In the current market, stablecoins have gained popularity in the cryptocurrency space due to their potential to offer the benefits of digital assets, such as fast and borderless transactions, while mitigating the price volatility that is a common characteristic of cryptocurrencies like Bitcoin and Ethereum. Stablecoins are often used as a medium of exchange, a store of value, or a unit of account within decentralized finance (DeFi) applications, smart contracts, and various blockchain ecosystems. Moreover, they also serve as a bridge between traditional financial systems and the crypto space, providing users with a more stable means of transacting value.

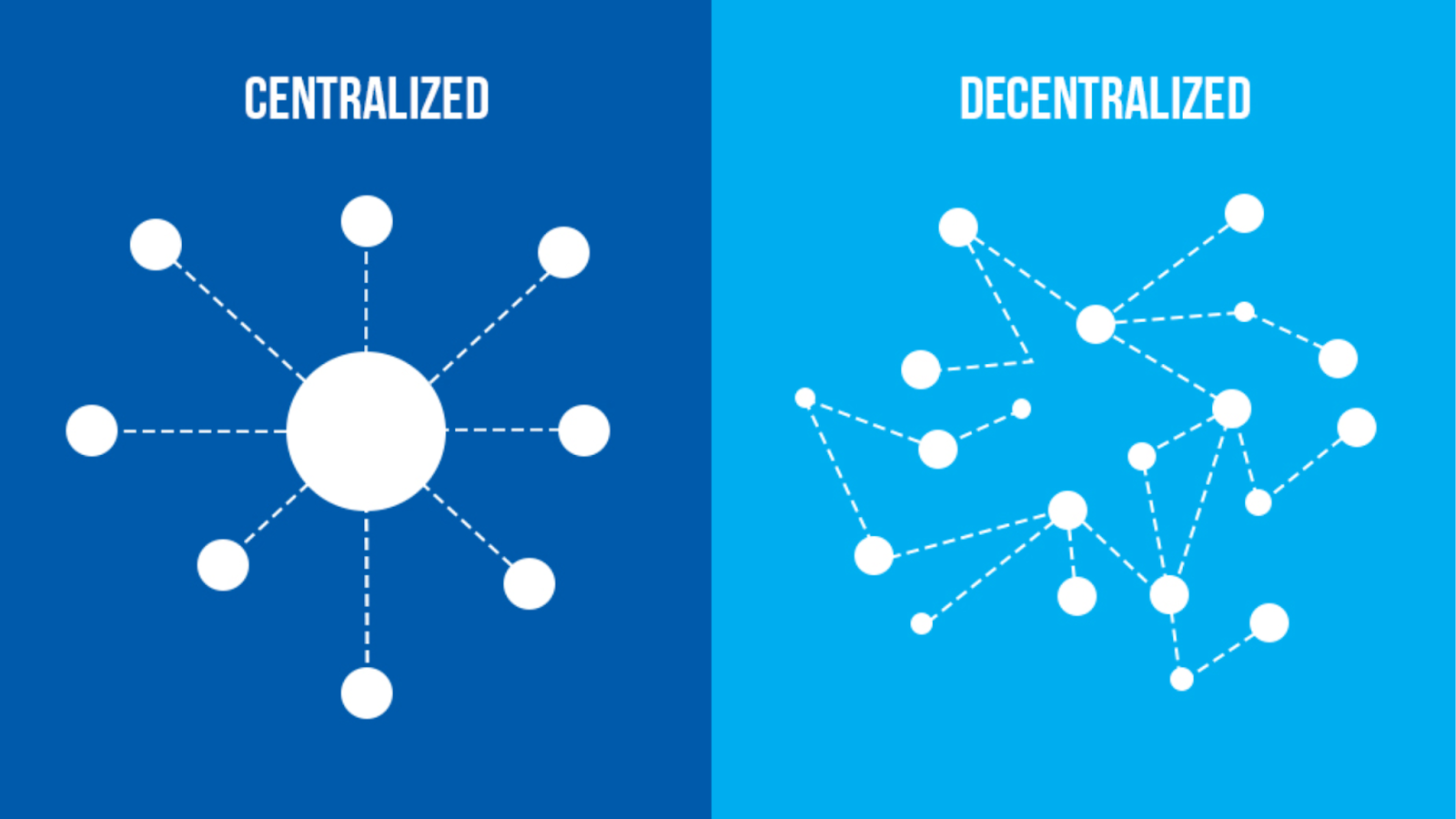

Centralized vs. Decentralized Stablecoins

Centralized and decentralized stablecoins represent two different approaches to achieving stability in the value of a cryptocurrency. The key distinction lies in the governance, control, and underlying mechanisms used to maintain the stablecoin’s peg to a specific value, such as a fiat currency like the US dollar.

Now, we will make a small comparison between centralized and decentralized stablecoins to help you get a deeper understanding of these two types of stablecoins. Let’s dive in!

Centralized Stablecoins

- Issued by Centralized Entities:

- Typically, centralized stablecoins are issued and managed by a centralized entity like a company or financial institution, whose responsibility is maintaining the reserve of assets backing the stablecoin.

- Collateralized by Centralized Reserves:

- The value is often collateralized by assets held in a centralized reserve. These assets can include fiat currencies, government bonds, or other financial instruments.

- Custodial Control:

- Centralized stablecoins require users to trust the issuing entity with custody of the underlying assets. Therefore, users may need to rely on the stability and integrity of the centralized organization.

- Issuer’s Discretion:

- The issuing entity has the discretion to mint or burn stablecoins based on demand. That’s why this centralized control allows for more direct management of the stablecoin’s supply.

- Regulatory Oversight:

- Centralized stablecoins may be subject to regulatory oversight, especially if they are pegged to fiat currencies. Consequently, compliance with financial regulations, such as KYC (Know Your Customer) and AML (Anti-Money Laundering), is often required.

Examples of Centralized stablecoins:

Tether (USDT) and USD Coin (USDC) – These stablecoins are issued by specific companies and are typically pegged to the US dollar.

Decentralized Stablecoins

- Smart Contract Governance: Decentralized stablecoins often rely on smart contracts and decentralized governance mechanisms to maintain stability. As a result, algorithms and protocols are required to control the issuance and management of the stablecoin.

- Collateralized or Algorithmic Models:

- Decentralized stablecoins can be collateralized by other cryptocurrencies or may use algorithmic models to adjust the stablecoin’s supply dynamically based on market conditions.

- No Single Point of Control: Decentralized stablecoins aim to eliminate a single point of control, reducing reliance on a central authority. As a result, governance decisions may involve token holders participating in decentralized decision-making processes.

- Smart Contract Execution:

- Smart contracts execute the rules and algorithms governing the stablecoin’s stability, where users interact with these smart contracts to mint, redeem, or trade the stablecoin.

- Resilience to Centralized Risks:

- Decentralized stablecoins seek to reduce counterparty risk associated with centralized entities, which results in the community-driven nature of decentralized governance aiming to enhance resilience.

Examples of decentralized stablecoins:

Dai (collateralized stablecoin on Ethereum) and Ampleforth (algorithmic stablecoin) – Its operate on decentralized platforms and leverage smart contracts for stability.

How Do Stablecoins Work?

Fiat-backed

These stablecoins are backed by a reserve of fiat currencies, such as the US dollar, in which the issuer holds an equivalent amount of fiat currency in a bank account for each unit of the stablecoin in circulation.

For example:

- Tether (USDT): Pegged to the US dollar, Tether is one of the most widely used fiat-collateralized stablecoins.

- USD Coin (USDC): A stablecoin pegged to the US dollar and backed by a reserve of US dollars.

Crypto-backed

These stablecoins are backed by a reserve of other cryptocurrencies. The value is maintained by over-collateralizing the stablecoin with a basket of cryptocurrencies, and smart contracts are used to ensure stability.

For example:

- Dai: A stablecoin on the Ethereum blockchain, backed by a pool of diverse cryptocurrencies. It is governed by the MakerDAO protocol.

- sUSD (Synthetix USD): A stablecoin within the Synthetix protocol, backed by a pool of various cryptocurrencies.

Commodity-backed

Commodity-collateralized stablecoins are a subset of stablecoins that are backed by physical commodities. Unlike fiat-collateralized stablecoins (which are backed by traditional currencies like the US dollar) or crypto-collateralized stablecoins (which are backed by other cryptocurrencies), commodity-collateralized stablecoins derive their value from tangible assets like precious metals, agricultural products, or other commodities.

For example:

- Digix Gold (DGX):

- A stablecoin collateralized by physical gold, each of which represents 1 gram of gold, and users can redeem DGX tokens for actual gold bullion.

- PAX Gold (PAXG):

- A commodity-collateralized stablecoin backed by physical gold, each of which is backed by one fine troy ounce of a 400 oz London Good Delivery gold bar.

- Tether Gold (XAUT):

- Tether Gold represents ownership of one troy fine ounce of physical gold on a London Good Delivery gold bar held in a Swiss vault.

Algorithmic

These stablecoins use algorithms to control the supply and demand dynamically, adjusting the quantity of coins in circulation to maintain stability. Therefore, they are not directly backed by collateral but instead rely on algorithmic mechanisms.

For example:

- Ampleforth (AMPL): An algorithmic stablecoin that adjusts its supply based on demand, targeting a constant unit value.

- Terra (LUNA): A stablecoin ecosystem that uses algorithmic mechanisms and a dual-token model for stability.

Benefits of Using Stablecoins

Price Stability

Stablecoins are designed to maintain a stable value, mitigating the price volatility often associated with other cryptocurrencies like Bitcoin and Ethereum. Thanks to this characteristic, this stability makes them more suitable for everyday transactions and as a store of value.

Fast and Cheap Transactions

Stablecoins provide a means of conducting transactions with the benefits of cryptocurrencies, such as fast and borderless transfers, without the concern of price fluctuations, which ultimately makes them appropriate for daily transactions, remittances, and cross-border payments.

Access to Decentralized Finance

Stablecoins play a crucial role in decentralized finance (DeFi) applications by providing liquidity for lending and borrowing protocols. Consequently, users can collateralize stablecoins to access loans or earn interest by supplying them to liquidity pools.

Risks Associated with Stablecoins

Centralization

Centralized stablecoins are issued and controlled by a central entity. That is the reason why If this entity faces regulatory issues, financial difficulties, or fails to maintain proper reserves, it could impact the stability and value of the stablecoin.

Smart Contract Vulnerabilities

Since stablecoins that rely on smart contracts are susceptible to code vulnerabilities, exploitable bugs or security flaws in the smart contract could lead to loss of funds or instability in the stablecoin’s value.

Regulation

Stablecoins, especially those pegged to fiat currencies, may face regulatory scrutiny, so changes in regulatory policies or legal challenges could impact the ability to operate and redeem stablecoins.

Conclusion

To sum up, there are two main types of Stablecoins including centralized and decentralized stablecoins. Both have their advantages and drawbacks, and the choice between them depends on user preferences, regulatory considerations, and the specific use case within the cryptocurrency ecosystem.

Moreover, it is essential to clearly understand the advantages and disadvantages of stablecoins when using it because it may influence your investment.

About Herond Browser

Herond Browser is a Web browser that prioritizes users’ privacy by blocking ads and cookie trackers, while offering fast browsing speed and low bandwidth

consumption. Herond Browser features two built-in key products:

- Herond Shield: an adblock and privacy protection tool;

- Herond Wallet: a multi-chain, non-custodial social wallet.

Herond aims at becoming the ultimate Web 2.5 solution that sets the ground to further accelerate the growth of Web 3.0, heading towards the future of mass adoption.

Join our Community!