Gaining a positive ROI is the top concern in the world of investment generally. However, do you know that in the realm of Blockchain Technology, Cryptocurrency has become a potential source for sustainable returns. Under the view of investors, cryptocurrency is a good long-term investment depending on various factors such as individual preferences, risk management, and investment targets.

This article aims to provide you an overall outlook of ROI on Crypto. Moreover, we will discuss the ways to calculate and generate positive ROI from cryptocurrency. Let’s dive in!

What is ROI on Crypto?

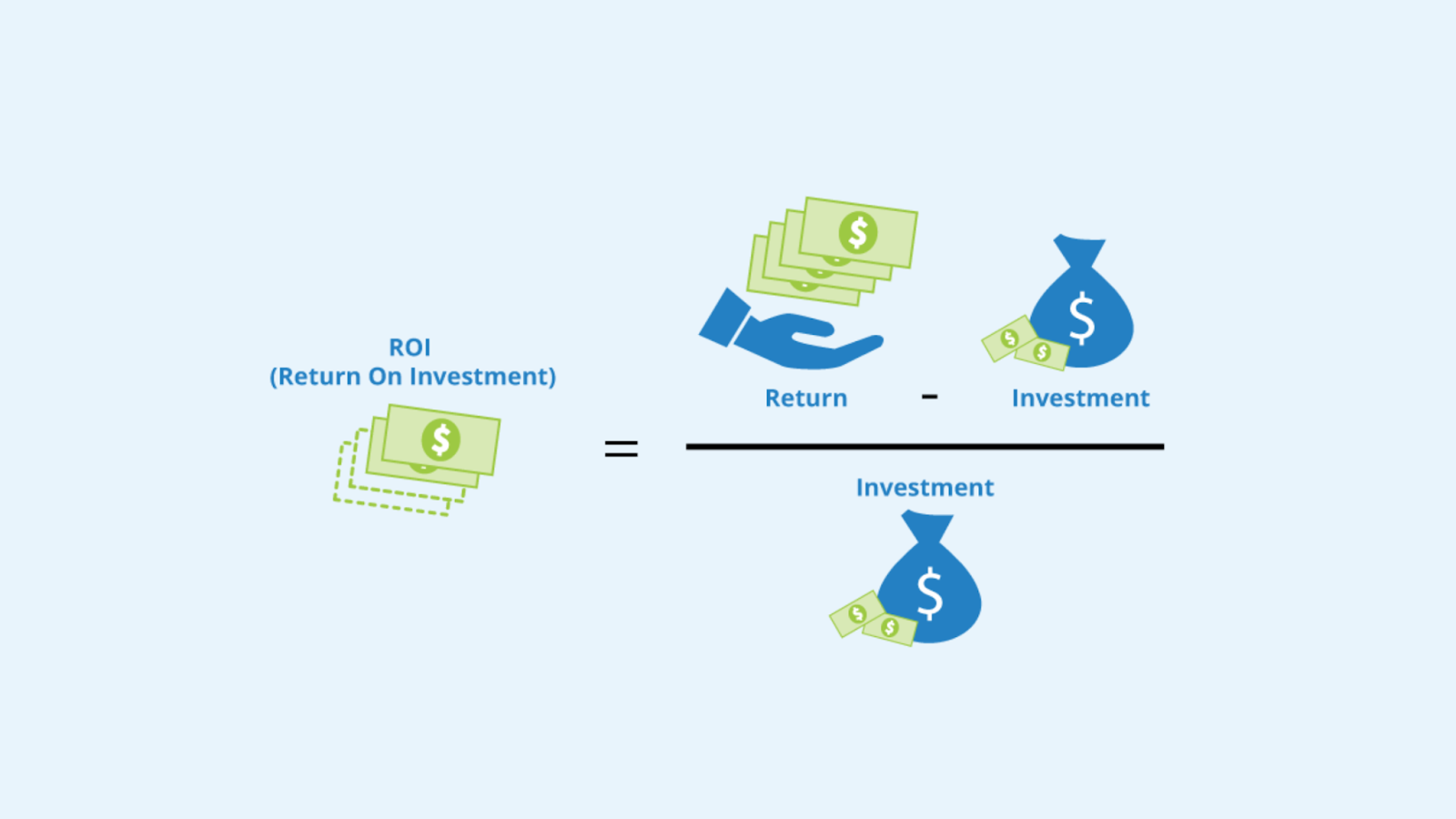

ROI, or Return on Investment, is a financial measure used to assess the profitability of an investment relative to its initial cost. In the realm of cryptocurrency, ROI denotes the percentage gain or loss on an investment in a specific cryptocurrency or a collection of cryptocurrencies during a defined timeframe.

In other words, it quantifies the difference between the current market value of the investment and its initial cost, expressed as a percentage.

Does crypto generate good ROI in the long run?

Whether cryptocurrency is a good long-term investment depends on various factors, including your risk tolerance, investment goals, and market conditions. Here are some considerations to help you assess whether crypto is suitable for long-term investment:

- Volatility: Cryptocurrency markets are known for their high volatility, with prices often experiencing significant fluctuations in short periods. While this volatility can present opportunities for substantial gains, it also entails higher risk, which may not be suitable for all investors, especially those with low risk tolerance.

- Market Maturity: The cryptocurrency market is relatively young and still evolving. While this presents opportunities for growth and innovation, it also means there is greater uncertainty and unpredictability compared to more established asset classes like stocks or bonds.

- Market Performance: If your investment outperforms the market average, it may be considered a good ROI. Conversely, it may indicate room for improvement.

- Risk-Adjusted Returns: Higher returns are generally expected for riskier investments.

- Investment Horizon: Short-term fluctuations in crypto prices can be volatile, so a longer investment horizon may provide a more accurate assessment of ROI.

- Financial Goals: Determine whether the achieved ROI aligns with your expectations and whether it helps you progress towards your financial goals.

- Consistency: A series of positive returns may indicate a successful investment strategy. Conversely, inconsistent or negative returns may require reassessment of the investment approach.

- Diversification: Diversifying across different cryptocurrencies or asset classes can help mitigate risk and improve overall portfolio performance.

How to Calculate ROI on Crypto in the long term

We hereby use the quation to calculate ROI on Crypto in the long term as below:

ROI = (Net Return / Initial Investment) x 100

Now, take an example, just consider a long-term investment where you purchase $6,000 worth of a different crypto asset and hold it for a year. At the end of the year, the value of your investment grows to $12,000. Apply the respective number into the equation:

The net return here is $12,000 – $6,000 = $6,000. Thus, the ROI = ($6,000 / $6,000) x 100 = 100%.

As a result, in this scenario, your long-term investment in the crypto asset yielded a 100% ROI.

How to Make Positive ROI While Investing in Crypto in the Long Term

Making a positive return on investment (ROI) while investing in cryptocurrency requires careful planning, research, and risk management.

Here are some strategies to help you achieve a positive ROI in crypto investing:

Do Your Research

Thoroughly do your own research (DYOR) on the cryptocurrency projects you are interested in before investing. For example, you can evaluate factors such as the team behind the project, the technology, the use case, market demand, and the project’s roadmap.

Diversify Your Portfolio

Diversification is key to managing risk in crypto investing. In other words, you should allocate your investment across multiple cryptocurrencies, projects, and asset classes to spread risk and reduce exposure to any single asset. Therefore, this can help mitigate the impact of volatility and potential losses.

Stay Informed

It is important to always stay up-to-date with the latest news, developments, and trends in the cryptocurrency market. Follow reputable sources of information, join crypto communities and forums, and engage with other investors to stay informed about market dynamics and potential investment opportunities.

Manage Risk

Implement risk management strategies to protect your investment capital. Set stop-loss orders to limit potential losses, diversify across different assets, and only invest what you can afford to lose. Avoid investing more than you’re willing to lose, and be prepared for the possibility of market downturns.

Stay Disciplined

Remember that you are investing for the long run, so always stick to your investment strategy. Importantly, you must avoid making impulsive decisions based on emotions or short-term market movements.

Use Fundamental and Technical Analysis

Use both fundamental and technical analysis to inform your investment decisions. On the one hand, fundamental analysis involves evaluating the underlying fundamentals of a project. On the other hand, technical analysis involves analyzing price charts and market data to identify trends and patterns.

Risks of Gaining ROI on Cryptocurrency

Investing in cryptocurrency carries several risks that investors should be aware of before committing capital. Here are some of the key risks associated with cryptocurrency investing:

- Volatility: Price volatility can lead to substantial gains but also significant losses, making it challenging to predict market movements accurately.

- Regulatory Risk: Regulatory crackdowns or restrictive measures can affect investor sentiment and market liquidity.

- Security Risks: Cryptocurrency exchanges and wallets are frequent targets for cyberattacks, and investors may lose their funds if their accounts are compromised.

- Market Manipulation: Pump-and-dump schemes, spoofing, and other forms of market manipulation can artificially inflate or deflate prices, leading to losses for unsuspecting investors.

- Lack of Regulation: The cryptocurrency market is still relatively young and lacks the same level of regulation and oversight as traditional financial markets. As a result, the absence of regulatory safeguards increases the risk of fraud, market manipulation, and investor abuse.

- Technological Risks: For example, smart contract vulnerabilities, blockchain forks, and protocol changes can impact the value and usability of cryptocurrency assets.

- Investment Scams: The cryptocurrency market is rife with investment scams, Ponzi schemes, and fraudulent projects seeking to exploit unsuspecting investors.

- Liquidity Risk: Some cryptocurrencies may have low liquidity, meaning there may not be enough buyers or sellers in the market to execute large trades without significantly impacting prices.

- Market Sentiment: Cryptocurrency prices are influenced by market sentiment, speculation, and investor psychology. FOMO (fear of missing out) and FUD (fear, uncertainty, and doubt) can drive irrational price movements and herd behavior, leading to market bubbles and crashes.

- Operational Risks: Loss of access to private keys, hardware failures, and human error can result in the permanent loss of cryptocurrency funds.

Conclusion

To sum up, cryptocurrency is a good long-term investment depending on your individual circumstances, risk tolerance, and investment objectives. Therefore, it can be assured that cryptocurrency has great potential to generate good ROI in the long term.

However, while ROI is a valuable tool for evaluating cryptocurrency investments, it is essential to consider factors like risk, volatility, and market conditions. Moreover, ROI calculations may not encompass additional expenses such as transaction fees or taxes.

About Herond Browser

Herond Browser is a Web browser that prioritizes users’ privacy by blocking ads and cookie trackers, while offering fast browsing speed and low bandwidth consumption. Herond Browser features two built-in key products:

- Herond Shield: an adblock and privacy protection tool;

- Herond Wallet: a multi-chain, non-custodial social wallet.

Herond aims at becoming the ultimate Web 2.5 solution that sets the ground to further accelerate the growth of Web 3.0, heading towards the future of mass adoption.

Join our Community!