Bitcoin is a decentralized digital currency that operates on a peer-to-peer network, enabling users to send and receive payments without intermediaries like banks. However, a crucial aspect of using Bitcoin is understanding network fees—the costs associated with processing and confirming transactions on the blockchain. These fees not only ensure that transactions are validated by miners but also help manage the flow of data in the Bitcoin network. In this article, we will explore the fundamentals of Bitcoin network fee, how they work, and tips for managing them effectively.

What Are Bitcoin Network Fees?

Bitcoin network fees, commonly referred to as transaction fees, are small amounts of Bitcoin paid to miners for including a transaction in a block. Miners, who secure the network by validating transactions and adding them to the blockchain, are incentivized through both block rewards and transaction fees. The fees ensure that the Bitcoin network continues to function smoothly by providing an incentive for miners to prioritize and confirm transactions.

- Paid by the Sender: When sending Bitcoin, the sender is responsible for paying the fee, which is automatically deducted from the total balance.

- Incentive for Miners: Miners typically prioritize transactions with higher fees, especially when the network is congested, to maximize their earnings.

How Bitcoin Network Fee Works

Bitcoin network fees are based on the data size of the transaction rather than the amount of Bitcoin being sent. The larger the transaction in bytes (data size), the higher the fee.

Several factors influence the fee:

- Transaction Size: A transaction with multiple inputs and outputs (such as consolidating several smaller Bitcoin amounts into a larger one) will take up more space on the blockchain and therefore incur higher fees.

- Network Congestion: When the Bitcoin network is busy, there’s more competition to get transactions included in blocks. During these times, fees typically increase, as users are willing to pay more to ensure their transactions are processed quickly.

- Fee per Byte (or Satoshi per Byte): Fees are usually calculated in Satoshis per byte, where one Satoshi is 0.00000001 BTC. Users can set a higher fee per byte to prioritize their transaction, especially during periods of high demand.

Why Bitcoin Network Fee Varies

The amount you pay in fees can fluctuate significantly based on several conditions:

- Network Traffic: If many people are using the network simultaneously, miners will prioritize transactions with higher fees. This can lead to a surge in fees during times of high demand.

- Block Space Availability: Bitcoin blocks are limited in size to 1MB, meaning they can only hold a finite number of transactions. During busy periods, blocks fill up quickly, forcing users to compete for space by offering higher fees.

- Mempool Backlog: The mempool is where unconfirmed transactions wait to be added to a block. If the mempool becomes congested, users often increase their transaction fees to ensure faster processing.

How to Choose the Right Bitcoin Transaction Fee

Choosing the right fee depends on how quickly you need your transaction to be confirmed. If you are not in a hurry, you can pay a lower fee and wait longer for your transaction to be confirmed. If speed is essential, paying a higher fee ensures that miners will prioritize your transaction.

- Use a Fee Estimator: Many Bitcoin wallets and platforms include fee estimators, which suggest an appropriate fee based on current network conditions. These estimators help you choose between low, medium, or high-priority fees.

- Consider Transaction Urgency: For regular transactions, such as day-to-day payments, opting for a lower fee may be fine if you’re willing to wait a few hours for confirmation. However, for urgent transactions, paying a higher fee is worth it to ensure prompt processing.

- Custom Fees: Some wallets allow you to set custom transaction fees. If you’re experienced, you can manually adjust fees based on the mempool status or expected network activity.

Tips for Managing Bitcoin Network Fees

Here are suggested tips to manage Bitcoin Network Fee.

Tip 1: Transact During Off-Peak Times

Bitcoin network traffic ebbs and flows throughout the day. Transactions during quieter periods tend to incur lower fees, as there is less competition for block space. You can monitor network traffic using Bitcoin fee tracking tools or mempool monitoring services.

Tip 2: Use Segregated Witness (SegWit) Addresses

Segregated Witness, or SegWit, is an upgrade to the Bitcoin protocol that reduces the size of transactions, thus lowering fees. When using a SegWit-enabled wallet or address, your transactions take up less space on the blockchain. Therefore, it allows you to pay lower fees.

Tip 3: Batch Transactions

If you need to send Bitcoin to multiple recipients, consider using a transaction batching strategy. This involves combining multiple payments into a single transaction. Consequently, it helps to reduce the overall data size compared to sending each payment individually, saving on fees.

Tip 4: Consolidate Small Inputs

If your Bitcoin wallet has multiple small unspent transaction outputs (UTXOs), it may lead to higher transaction fees when sending Bitcoin. Consider consolidating these UTXOs into fewer outputs when the network is less congested. This practice helps optimize your wallet and minimizes future transaction fees.

How Fees Are Changing Over Time

Over time, the structure of Bitcoin network fees may change as the Bitcoin network evolves:

- Block Reward Halvings: Roughly every four years, the reward that miners receive for adding a block to the blockchain is halved. As block rewards decrease, miners will rely more on transaction fees for their income, potentially leading to higher fees in the future.

- Scalability Solutions: Several proposed scalability solutions, such as the Lightning Network, aim to reduce congestion on the Bitcoin mainnet by facilitating off-chain transactions. The adoption of these solutions could help lower fees for everyday transactions in the long term.

Conclusion

Understanding Bitcoin network fees is essential for effectively managing your cryptocurrency transactions. By knowing how fees are calculated and what factors influence them, you can better optimize your transactions, reduce costs, and avoid unnecessary delays. Whether you’re sending Bitcoin for business or personal use, keeping an eye on network conditions and using the right strategies can help you navigate Bitcoin network fees efficiently.

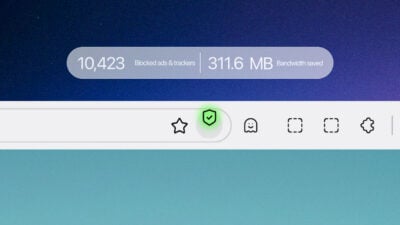

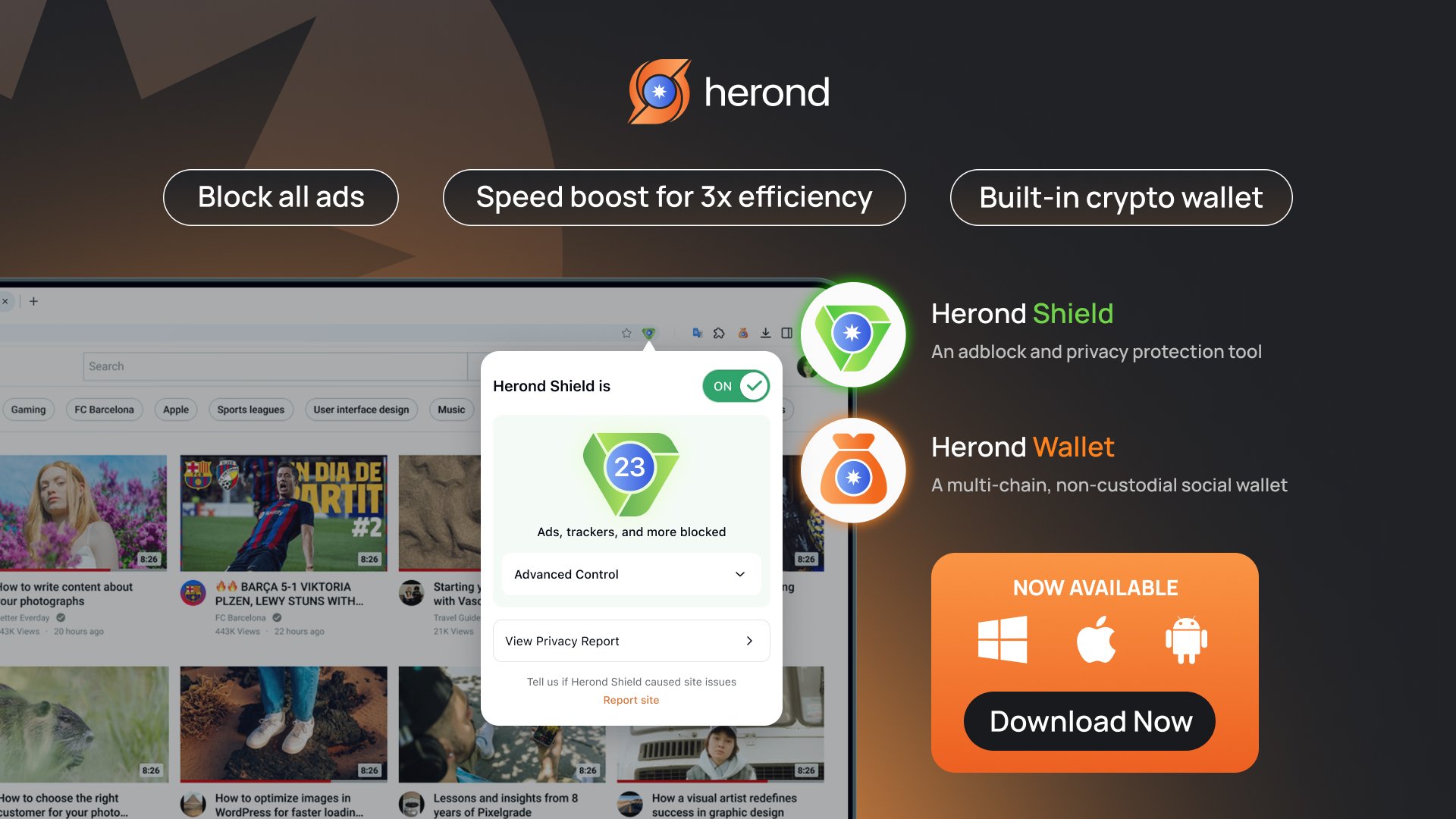

About Herond Browser

Herond Browser is a Web browser that prioritizes users’ privacy by blocking ads and cookie trackers, while offering fast browsing speed and low bandwidth consumption. Herond Browser features two built-in key products:

- Herond Shield: an adblock and privacy protection tool;

- Herond Wallet: a multi-chain, non-custodial social wallet.

Herond aims at becoming the ultimate Web 3.0 solution, heading towards the future of mass adoption. Herond has now released the mobile version on CH Play and App Store. Join our Community!