Ethereum is a powerful platform that makes it easy to create decentralized applications (DApps). These apps run on blockchain technology, which means they are secure, transparent, and not controlled by a single company. Ethereum has become a leader in this space, offering exciting ways for people to manage their money and use digital services. In this blog, we’ll introduce you to the top 5 new Ethereum DApps you should try and explain why they are popular and useful.

Learn more: What Are Dapps and Why Are They Important in Web3?

What are Ethereum Dapps?

A Decentralized Application (DApp) is an app that runs on a blockchain network instead of being controlled by a single company or server. This makes DApps more secure, transparent, and independent than regular apps. When you use a DApp, your information is stored on the blockchain and checked by many computers (called nodes), not just one system.

DApps can be used for many things, like sending money (DeFi), playing games, tracking products in supply chains, voting, and creating digital art (NFTs). They work using smart contracts—computer programs that automatically do tasks when certain conditions are met. Once a smart contract is added to the blockchain, it’s very hard to change or remove, so the DApp can keep working even if its creators stop supporting it.

To use a DApp on Ethereum, you need a crypto wallet (like Herond Wallet) and some ETH to pay for transactions. DApps are changing how businesses work and creating new ways for people to use technology.

Learn more: A Beginner’s Guide to Yield Farming in DeFi

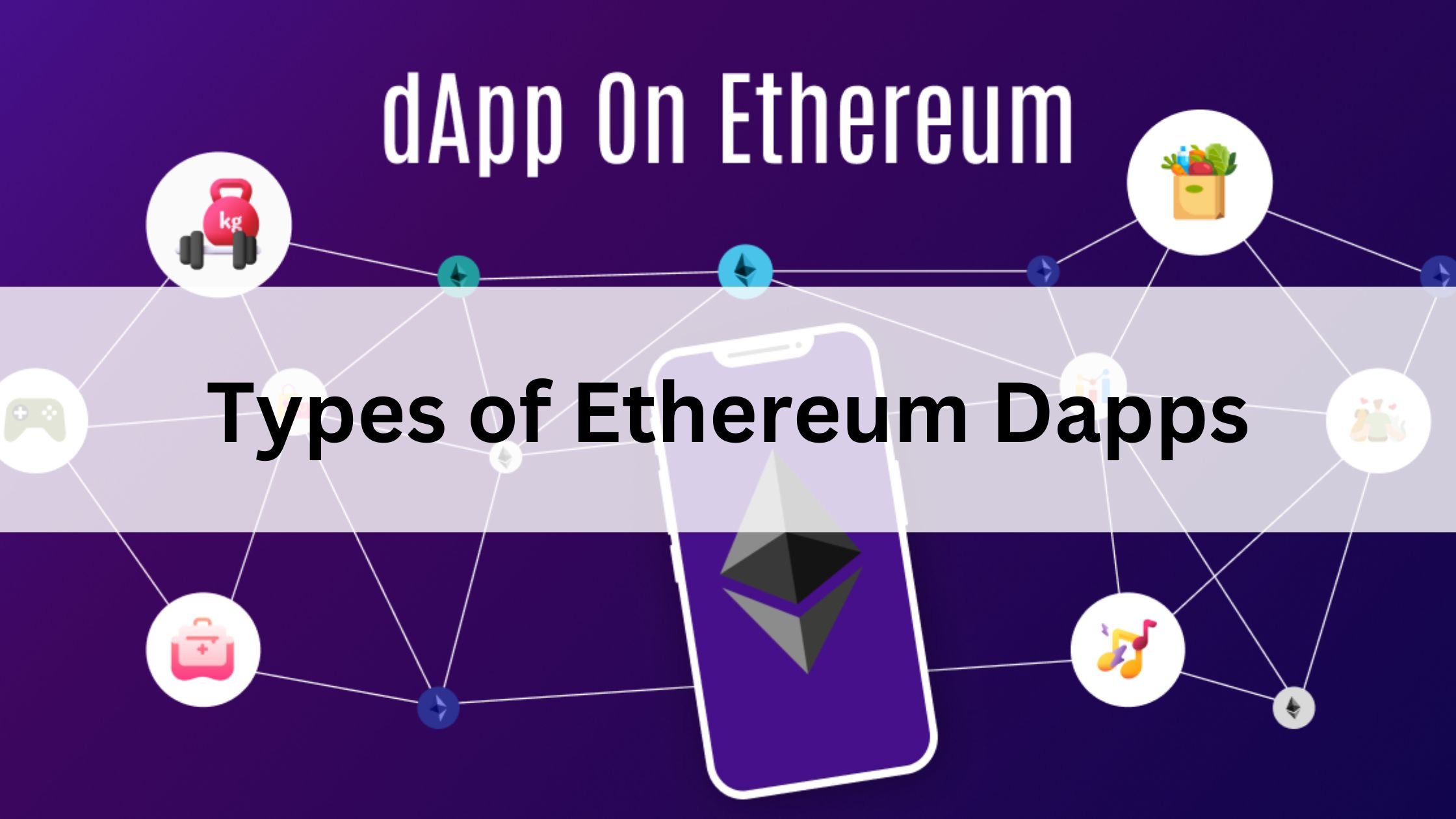

Types of Ethereum Dapps

Ethereum apps, called DApps (Decentralized Applications), are growing in many different areas. Each type of DApp offers something new and useful. Let’s break down the main types of new Ethereum DApps in a simple way:

DeFi (Decentralized Finance) Apps

These apps let people manage money without using banks or other middlemen.

- Lending and Borrowing: You can lend your crypto to earn interest or borrow crypto by putting up collateral.

- Aave: Lend and borrow crypto with flexible interest rates.

- Compound: Earn interest or borrow crypto using smart contracts.

- Decentralized Exchanges (DEXs): Trade cryptocurrencies directly with others, no central company needed.

- Uniswap: Swap tokens easily from your wallet.

- SushiSwap: Trade tokens and earn rewards.

Blockchain Gaming and Virtual Worlds

These games and virtual spaces let players own and trade in-game items as NFTs.

- Decentraland: A virtual world where you can buy land, build, and explore.

- CryptoKitties: A game where you collect and breed digital cats.

DAOs (Decentralized Autonomous Organizations)

DAOs are online communities where members vote on decisions, with no bosses or managers.

- MakerDAO: Lets users vote on how the DAI stablecoin works.

- Aragon: Helps people create and run their own DAOs.

Real-World Asset (RWA) Platforms

These apps bring real-world items, like property and loans, onto the blockchain by turning them into tokens.

- Centrifuge: Turns things like invoices into tokens for easier business loans.

- Ondo Finance: Makes it possible to invest in tokenized bonds.

Yield Aggregators

These apps help users earn more by moving their crypto to the best earning options automatically.

- Yearn Finance: Finds the best ways for users to earn interest.

- Harvest Finance: Collects and reinvests profits to grow users’ money.

Ethereum DApps are changing how we handle money, play games, and work together—making things faster, easier, and more open to everyone.

Top 5 Ethereum DApps You Need to Try

Here are five leading new Ethereum DApps that have made a big impact on the world of decentralized finance (DeFi). These apps showcase the innovation and growth of the Ethereum network, giving users new ways to interact with DeFi and helping drive the wider use of blockchain technology.

Uniswap

Uniswap is a leading decentralized exchange (DEX) on Ethereum, allowing users to trade cryptocurrencies directly from their wallets without intermediaries. It uses an automated system to set prices and provide liquidity. As of August 2024, Uniswap has facilitated over $1 trillion in trading volume, highlighting its significant role in decentralized finance (DeFi).

Analysts have varying predictions for Uniswap’s UNI token:

- AMB Crypto suggests a gradual increase, with UNI reaching $24.12 in 2024 and potentially $1,724.19 by 2030, indicating strong long-term growth.

- SwapSpace offers a more conservative estimate, with UNI expected to be around $11.10 in 2024 and $24.15 by 2030.

- Coinlore forecasts UNI at $11.36 in 2024, $27.82 in 2025, and $54.49 by 2030.

These predictions reflect optimism about Uniswap’s continued prominence in the DeFi space.

Lido

Lido is a decentralized liquid staking protocol that allows users to stake their ETH and receive stETH tokens in return. These tokens represent staked ETH and can be used in other DeFi protocols, providing liquidity and staking rewards simultaneously. As of August 2024, Lido has a total value locked (TVL) of approximately $29.78 billion, with over 9.8 million ETH staked, making it the largest single depositor in Ethereum’s staking layer. Lido charges a 10% fee on staking rewards, split between node operators and the DAO Treasury, and offers an annual percentage rate (APR) of 2.9% on Ethereum.

Lido’s position as the leading liquid staking provider suggests it will continue to play a crucial role in Ethereum’s ecosystem. Its integration with various DeFi platforms and the growing adoption of liquid staking indicate potential for sustained growth.

MakerDAO

MakerDAO is a decentralized autonomous organization that manages the DAI stablecoin, which is pegged to the U.S. dollar. Users can lock up their crypto assets as collateral to mint DAI, facilitating decentralized lending and borrowing. As of August 2024, MakerDAO has over $8 billion in total value locked, underscoring its importance in the DeFi ecosystem.

MakerDAO’s DAI stablecoin remains a cornerstone of DeFi, providing stability in the volatile crypto market. As DeFi continues to expand, MakerDAO is expected to maintain its pivotal role, with potential growth in TVL and user adoption.

Learn more: Decentralized Finance (DeFi) and the Rise of dApps

Puffer Finance

Puffer Finance is a liquid restaking protocol that allows users to restake their ETH through EigenLayer, potentially earning extra rewards. In February 2024, Puffer Finance amassed over $135 million worth of Ether deposits within 24 hours of its launch, ranking it among the top liquid restaking providers.

Puffer Finance’s rapid growth indicates strong interest in liquid restaking solutions. Its focus on security and potential for higher yields positions it well for future expansion in the DeFi landscape.

Renzo

Renzo Protocol offers liquid restaking services by minting $ezETH, a liquid restaking token representing the user’s ETH or liquid staking token position. $ezETH secures Actively Validated Services (AVS) to generate both staking and restaking rewards.

Renzo’s innovative approach to liquid restaking and strategy management suggests it could become a significant player in the DeFi space. Its ability to offer users enhanced returns through restaking positions it for potential growth.

These DApps exemplify the innovation and growth within the Ethereum ecosystem, offering users various ways to engage with decentralized finance and contributing to the broader adoption of blockchain technology.

Conclusion

New Ethereum DApps are changing how we handle money and digital assets. The top 5 DApps – Uniswap, Lido, MakerDAO, Puffer Finance, and Renzo – offer easy and innovative ways to trade, stake, borrow, and earn rewards. Whether you’re new to crypto or an experienced user, these apps give you great opportunities to explore the world of decentralized finance. Try them out and see how Ethereum is shaping the future of digital technology!

Learn more: Top 5 KYC Solutions for Crypto in 2024

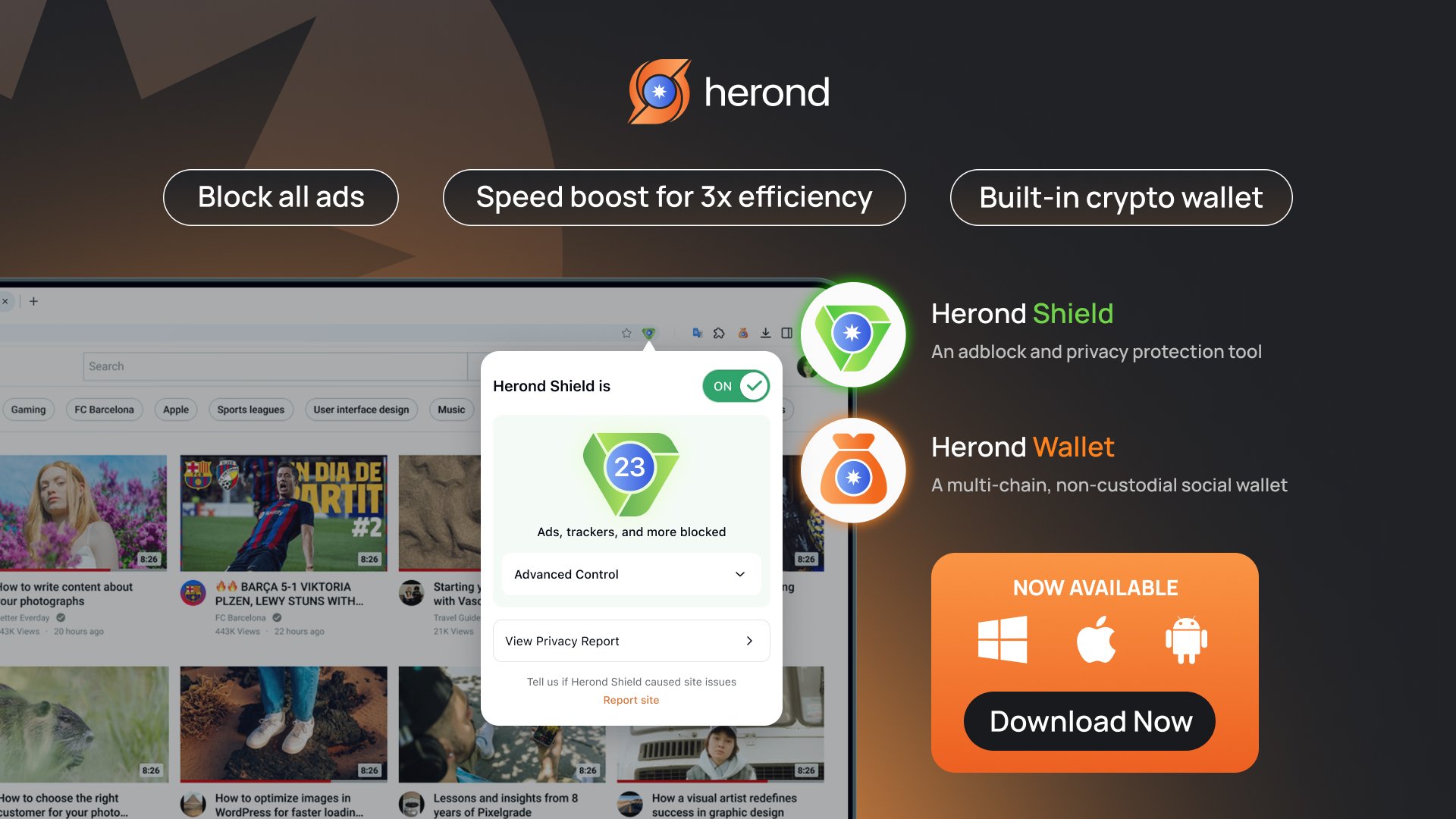

About Herond Browser

Herond Browser is a cutting-edge Web 3.0 browser designed to prioritize user privacy and security. By blocking intrusive ads, harmful trackers, and profiling cookies, Herond creates a safer and faster browsing experience while minimizing data consumption.

To enhance user control over their digital presence, Herond offers two essential tools:

- Herond Shield: A robust adblocker and privacy protection suite.

- Herond Wallet: A secure, multi-chain, non-custodial social wallet.

As a pioneering Web 2.5 solution, Herond is paving the way for mass Web 3.0 adoption by providing a seamless transition for users while upholding the core principles of decentralization and user ownership.

Have any questions or suggestions? Contact us:

- On Telegram https://t.me/herond_browser

- DM our official X @HerondBrowser

- Technical support topic on https://community.herond.org