Bitcoin (BTC) has long been the subject of intense speculation and analysis. As the first and largest cryptocurrency, its price movements send ripples throughout the entire crypto market. Whether you’re a seasoned investor or a curious newcomer, understanding the potential future of BTC prices is essential. What factors drive its value? Where do experts see it heading next? In this article, we’ll dive deep into the latest Bitcoin predictions, exploring key insights, market trends, and expert opinions to help you navigate the ever-changing landscape of crypto investing.

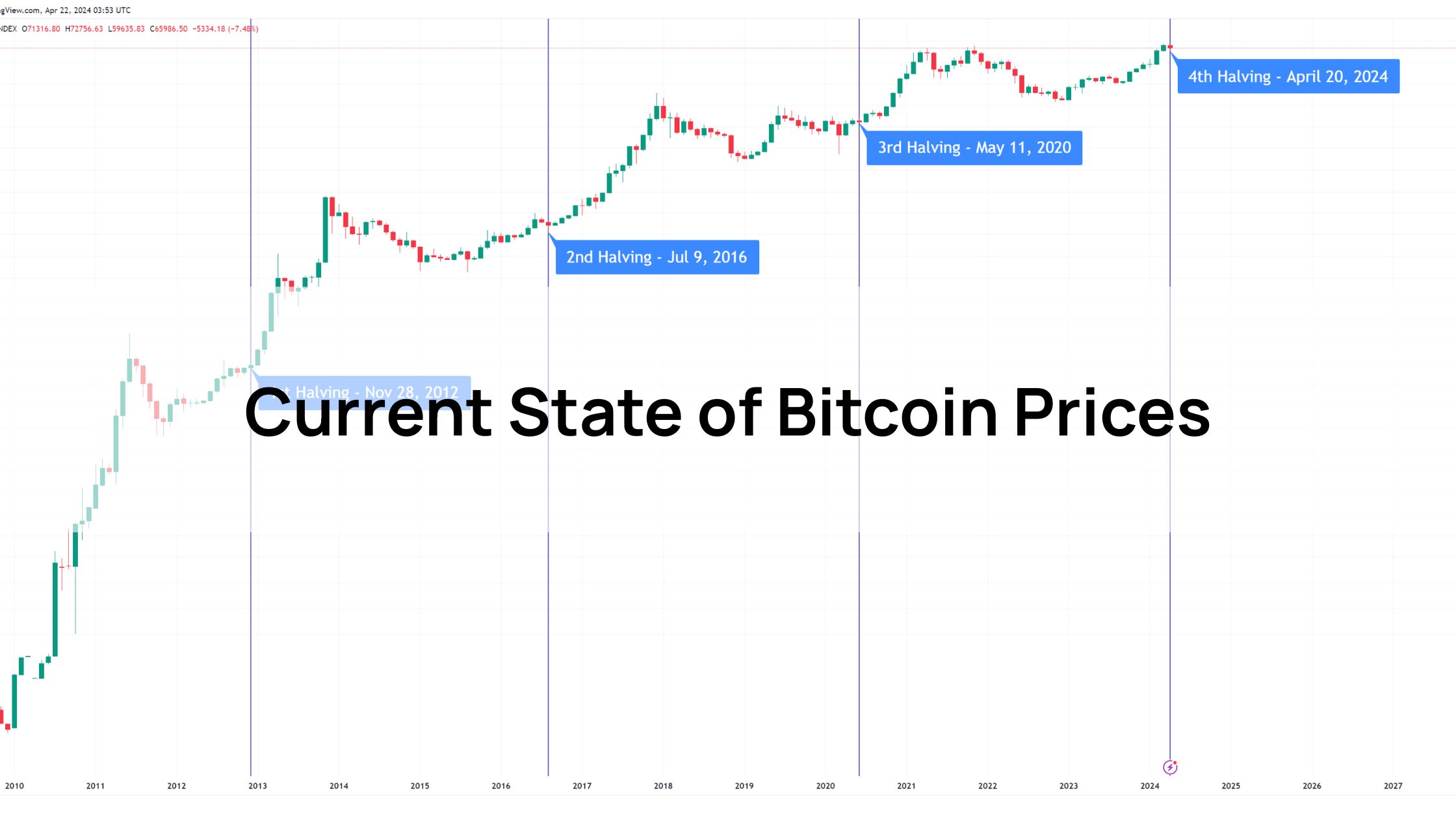

Current State of Bitcoin Prices

Recent Bitcoin Price Trends

Over the last quarter, Bitcoin (BTC) prices have experienced significant volatility, with a notable upward trend. According to data from sources like TradingView and CoinMarketCap, BTC recently spiked to a high of over $122,000, nearing its all-time high of approximately $123,236 set in July 2025. This surge followed a period of consolidation in June and July. Despite some fluctuations, the overall momentum has been positive, with Bitcoin’s price rising by over 100% in the last year alone, demonstrating strong long-term growth.

Key Market Influences Shaping BTC

Several key factors are currently influencing the price of Bitcoin. Regulatory news continues to be a major driver, with positive developments like the approval of U.S. spot Bitcoin ETFs attracting significant inflows, as seen with the $260 million in capital that flowed into Bitcoin-based funds last week. This indicates growing institutional adoption and a higher level of mainstream acceptance. Additionally, macroeconomic events, such as potential Federal Reserve rate cuts and new government regulations, are closely watched by traders. As a decentralized asset, Bitcoin is increasingly viewed as a hedge against traditional economic uncertainty, solidifying its role as “digital gold” in the eyes of many investors.

The Role of Herond in Your Crypto Journey

For those looking to navigate these market trends and invest in Bitcoin, Herond Browser provides a secure and efficient platform. Our seamless integration with leading decentralized exchanges, like Uniswap, allows you to trade cryptocurrencies directly within your browser. With Herond, you can stay informed with the latest market data, execute trades with confidence, and secure your digital assets, all while enjoying a fast, private, and decentralized Web3 experience.

Factors Influencing Bitcoin Prices

Key Factors Influencing Bitcoin Prices

The future of Bitcoin prices is influenced by key factors like macroeconomic trends (e.g., central bank policies), regulatory developments (e.g., ETF approvals), and technological advancements (e.g., Bitcoin halving). These factors, along with market sentiment, drive price movements and are crucial for understanding future predictions.

Recent Trends and Expert Sentiment

In 2025, the success of spot Bitcoin ETFs has driven unprecedented institutional demand. BlackRock’s iShares Bitcoin ETF (IBIT) alone holds over 742,000 BTC, signaling a major shift toward mainstream adoption. This, combined with a positive macroeconomic outlook, has pushed prices to a recent high of over $122,000.

Expert sentiment from prominent figures like Michael Saylor and analysts at CryptoQuant remains bullish. They note that the market is maturing, with on-chain data and technical indicators suggesting a strong foundation for continued growth, despite ongoing volatility.

Expert Bitcoin Predictions for 2025 and Beyond

Analysts present a range of Bitcoin predictions for the short and long term. On the bullish side, Peter Brandt and Bernstein analysts project BTC to hit between $150,000 to $200,000 by year-end, while Chamath Palihapitiya’s prediction reaches an ambitious $500,000 by October 2025.

For a more neutral outlook, analysts suggest an average price of $110,000 to $130,000, accounting for steady institutional inflows.

Conversely, a bearish scenario could see a price correction, with technical analysis identifying a key support level around $90,000 to $100,000 in case of an unexpected market downturn.

Short-Term vs. Long-Term Outlook for Bitcoin Predictions

Discuss short-term volatility

Short-term Bitcoin volatility is a constant, and recent trends are no different. In early August 2025, BTC saw a notable push toward the $116,848 mark, with some analysts forecasting a path to the $125,000 to $150,000 range. However, the market has also experienced minor pullbacks, with traders watching key support levels and potential CME futures gaps. These rapid fluctuations highlight the importance of staying informed and agile in the ever-changing crypto market.

The Long-Term Potential of Bitcoin

Beyond short-term trends, Bitcoin Predictions long-term potential is gaining significant momentum. Many experts, including seasoned trader Peter Brandt, view BTC as a superior store of value to gold, citing its fixed supply and decentralized nature. This makes it an ideal hedge against inflation. The successful launch of U.S. Spot Bitcoin ETFs have been a major catalyst for institutional adoption, bringing unprecedented capital into the market and paving the way for wider acceptance. These factors, combined with historical post-halving patterns, suggest a strong foundation for sustained growth in the years to come.

Learning from Historical Halving Cycles

To understand what might be next for Bitcoin, it’s helpful to look at its historical halving cycles. The most recent halving in April 2024, which reduced the supply of new BTC, has historically been a major catalyst for price rallies. In previous cycles, prices saw significant increases in the 12-18 months following a halving event. While the market has matured, these post-halving periods have consistently marked the beginning of new bull runs, suggesting a strong foundation for long-term growth is in place despite short-term volatility.

How to Stay Informed and Act on Bitcoin Predictions

Essential Tools for Tracking Bitcoin Prices

To stay ahead of the volatile crypto market, having the right tools is essential. Platforms like CoinMarketCap and CoinGecko are industry standards for tracking real-time BTC prices, market capitalization, and historical data. For more advanced analysis, TradingView offers powerful charting tools and technical indicators that help you visualize trends and make informed decisions. Using a privacy-focused browser like Herond ensures a seamless and secure experience on these platforms, blocking trackers and pop-up ads while you monitor the market.

Credible Sources for Crypto Updates

Staying informed is crucial, but so is knowing where to get your information. For reliable news and analysis, follow reputable news outlets such as CoinDesk and Cointelegraph. On social media, particularly X (formerly Twitter), consider following well-respected figures in crypto space. Influencers like Michael Saylor provide a bullish institutional perspective, while analysts like Peter Brandt offer insightful technical analysis. Remember, these voices can influence market sentiment, so a balanced approach is key.

A Cautious Approach to Investing

Before making any investment, it’s vital to prioritize safety. Always conduct your own research (DYOR) and only invest an amount you can afford to lose. The crypto market is volatile, and prices can fluctuate dramatically. A smart strategy is dollar-cost averaging, where you invest a fixed amount regularly to mitigate the impact of short-term price swings. As you begin your crypto journey, Herond Browser’s secure Web3 environment helps protect your assets and personal data from potential scams, giving you greater peace of mind.

Conclusion

In a market driven by both technical signals and unpredictable global events, the future of Bitcoin prices remains a topic of intense debate. While many analysts are bullish on BTC’s long-term potential, citing its scarcity and growing institutional adoption, the journey to new highs will likely be characterized by its signature volatility. As we’ve seen with recent market movements, factors like regulatory news, major economic shifts, and even geopolitical events can all dramatically influence short-term price action. Ultimately, staying informed and understanding the interplay of these forces is key for anyone looking to navigate the dynamic world of cryptocurrency.

About Herond

Herond Browser is a cutting-edge Web 3.0 browser designed to prioritize user privacy and security. By blocking intrusive ads, harmful trackers, and profiling cookies, Herond creates a safer and faster browsing experience while minimizing data consumption.

To enhance user control over their digital presence, Herond offers two essential tools:

- Herond Shield: A robust adblocker and privacy protection suite.

- Herond Wallet: A secure, multi-chain, non-custodial social wallet.

As a pioneering Web 2.5 solution, Herond is paving the way for mass Web 3.0 adoption by providing a seamless transition for users while upholding the core principles of decentralization and user ownership.

Have any questions or suggestions? Contact us:

- On Telegram https://t.me/herond_browser

- DM our official X @HerondBrowser

- Technical support topic on https://community.herond.org