When diving into the world of Cryptocurrency, there are more threats to be aware of than we think. On top of these threats, we usually hear of the “Pump and Dump” term. This kind of scam is considered unethical and illegal in many jurisdictions, as it constitutes market manipulation. So what is the right explanation of Pump and Dump in Cryptocurrency? Let’s discover with us!

What is a Crypto Pump-and-Dump?

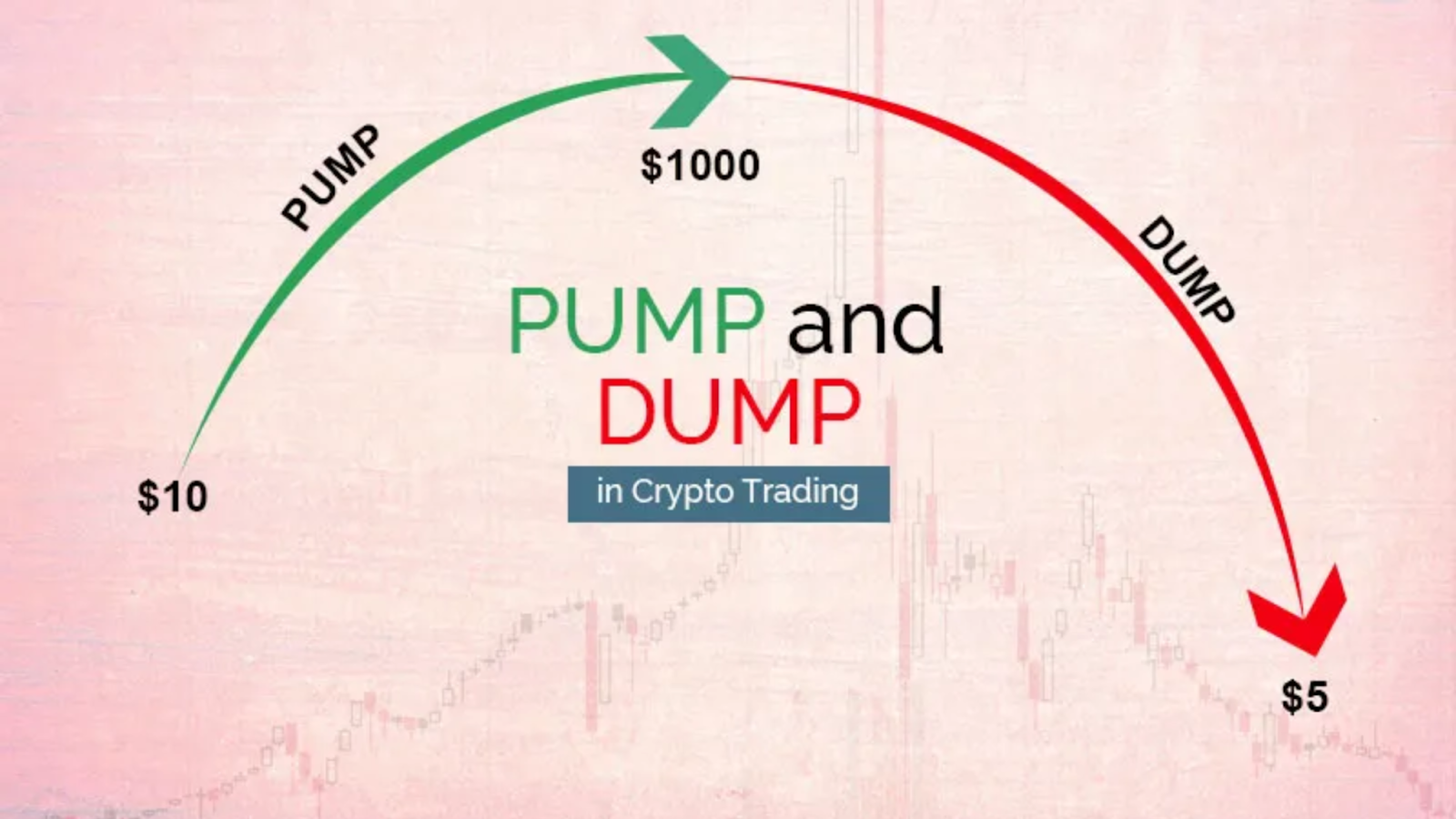

A crypto pump-and-dump is a form of market manipulation that occurs in the cryptocurrency markets. In more detail, it involves artificially inflating the price of a particular cryptocurrency through coordinated buying (the “pump”) followed by a rapid sell-off (the “dump”). Consequently, it results in significant profits for the perpetrators at the expense of unsuspecting investors.

How Crypto Pump and Dump Works

Let’s discover how crypto Pump and Dump works!

Phase 1: Initiation

A group of individuals are organized via social media platforms, chat rooms, or dedicated groups by using encrypted messaging apps to avoid detection. Then, they devise a strategy for the pump-and-dump, including selecting a target coin, determining the timing of the pump, and coordinating buying and selling activities.

Tactically, the perpetrators of the pump-and-dump scheme select a relatively low-market-cap cryptocurrency with low liquidity, which are easier to manipulate due to their smaller market size. The perpetrators coordinate their buying activities to create artificial demand for the cryptocurrency, driving up its price.

Phase 2: Expansion

The perpetrators create hype around the target coin by spreading false or exaggerated information. They may use social media posts, online forums, and targeted advertisements to promote the coin and attract investors.

Moreover, at the predetermined time, the perpetrators initiate the pump by simultaneously buying large amounts of the target coin. This coordinated buying activity creates artificial demand, causing the price of the cryptocurrency to surge rapidly.

As the price of the target coin starts to rise, other investors, influenced by the fear of missing out on potential profits, begin buying in as well with the hope to ride the momentum and make quick profits. Consequently, this further fuels the price increase.

Phase 3: Peak

At the peak of the pump, the price of the cryptocurrency reaches an artificially inflated level, often far beyond its fundamental value. This is when the perpetrators start selling off their holdings at a significant profit, taking advantage of the increased demand from other investors.

Phase 4: Dump

Once the perpetrators have offloaded their holdings and made substantial profits, they initiate the dump phase by selling off their remaining coins in large volumes. This sudden increase in selling pressure causes the price of the cryptocurrency to plummet rapidly.

Phase 5: Collapse

The dump phase results in a sharp decline in the price of the cryptocurrency, leaving investors who bought in during the pump phase with significant losses. Many of these investors may panic sell, exacerbating the price decline.

Phase 6: Exit

After successfully executing the pump-and-dump scheme, the perpetrators may move on to other targets or repeat the process with different cryptocurrencies.

Are Crypto Pump and Dumps legal?

Crypto pump and dump schemes are generally illegal in many jurisdictions. Literally, these schemes are considered forms of market manipulation and are subject to regulatory scrutiny and enforcement actions.

Now, we will explain to you the top reasons why they are illegal:

Securities Laws

In many countries, cryptocurrencies are considered securities, and trading them falls under securities laws. Therefore, market manipulation, including pump and dump schemes, is prohibited under these laws.

Anti-Fraud Regulations

Pump and dump schemes typically involve spreading false or misleading information to artificially inflate the price of a cryptocurrency. This constitutes fraud and is illegal under anti-fraud regulations.

Market Integrity

Pump and dump schemes undermine the integrity of financial markets by deceiving and defrauding investors. Regulators aim to maintain fair and orderly markets by prohibiting such manipulative practices.

Investor Protection

Pump and dump schemes pose significant risks to investors who may suffer losses as a result of participating in these schemes. Regulators enact laws and regulations to protect investors from fraudulent activities in the financial markets.

How to Spot a Crypto Pump and Dump

Spotting a crypto pump and dump scheme requires vigilance and skepticism, as these schemes can be deceptive. Here are top red flags to take into consideration:

Sudden and Unexplained Price Spikes

Be cautious of cryptocurrencies experiencing sudden and significant price increases with no apparent fundamental reason. Such spikes may indicate manipulation rather than organic market demand.

Abnormal Trading Volume

Look for cryptocurrencies with unusually high trading volumes relative to their market capitalization. This can suggest coordinated buying activity by pump groups.

Social Media Hype

Beware of excessive promotion of a cryptocurrency on social media platforms, forums, and chat rooms. Pump groups often use these channels to spread hype and lure unsuspecting investors.

Anonymous or Newly Created Accounts

Be skeptical of social media accounts aggressively promoting a cryptocurrency but having little to no history or credibility. Pump groups may create fake or anonymous accounts to avoid detection.

Whale Activity

Monitor large transactions by influential investors or “whales.” If significant amounts of the cryptocurrency are being accumulated by a small group of individuals, it could be a sign of a pump and dump in progress.

How to Avoid Crypto Pump and Dump

Here are several strategies to help you steer clear of these fraudulent activities.

Research Extensively

Thoroughly research any cryptocurrency project before investing. Evaluate its whitepaper, development team, technology, use case, and community engagement. Be wary of projects with vague or unrealistic claims.

Carefully Check Market Cap and Volume

Look for cryptocurrencies with established market capitalization and trading volume. Avoid investing in low-market-cap coins with low liquidity, as they are more susceptible to manipulation.

Verify Information Independently

Verify information from multiple credible sources before making investment decisions. Be skeptical of unsolicited investment advice and do your own due diligence.

Diversify Your Portfolio

Diversify your cryptocurrency investments across different projects and asset classes. This can help mitigate the impact of potential losses from pump and dump schemes.

Use Stop-Loss Orders

Consider using stop-loss orders to limit potential losses. These orders automatically sell your cryptocurrency holdings if the price drops to a predetermined level, helping protect your investment capital.

Report Suspicious Activities

If you come across suspicious pump and dump activities or fraudulent schemes, report them to the appropriate authorities or regulatory bodies. By reporting such activities, you can help protect other investors from falling victim to fraud.

Conclusion

Overall, a crypto pump-and-dump scheme relies on spreading false information, creating artificial demand, and manipulating market sentiment to generate profits for the perpetrators at the expense of unsuspecting investors. It is considered illegal and unethical, as it deceives and defrauds investors and undermines the integrity of the cryptocurrency markets.

As a result, it is essential for investors to be aware of the risks associated with pump and dump schemes and to conduct thorough research before investing in any cryptocurrency. In other words, investors should exercise caution, avoid FOMO (fear of missing out), and be skeptical of any project that promises unrealistic returns or experiences sudden and unsustainable price spikes.

About Herond Browser

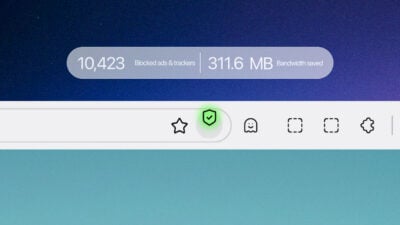

Herond Browser is a Web browser that prioritizes users’ privacy by blocking ads and cookie trackers, while offering fast browsing speed and low bandwidth consumption. Herond Browser features two built-in key products:

- Herond Shield: an adblock and privacy protection tool;

- Herond Wallet: a multi-chain, non-custodial social wallet.

Herond aims at becoming the ultimate Web 2.5 solution that sets the ground to further accelerate the growth of Web 3.0, heading towards the future of mass adoption.

Join our Community!