As cryptocurrencies like Ethereum continue to reshape the financial landscape, traditional investors are increasingly looking for ways to participate in this digital revolution – without the complexities of directly owning and managing crypto assets. Enter the Ethereum ETF (Exchange-Traded Fund), a groundbreaking financial product that offers a simplified, regulated, and accessible route to gain exposure to Ethereum. But what exactly is an Ethereum ETF, and how does it work? This article aims to explore the key features of Ethereum ETFs, how they allow investors to benefit from Ethereum’s growth, and why they are becoming a popular choice for those seeking to tap into the potential of cryptocurrency without the technical challenges. Whether you’re new to crypto or a seasoned investor looking to diversify, understanding how Ethereum ETFs function could be your next step toward navigating the crypto market with confidence.

What Is an ETF?

An ETF (Exchange-Traded Fund) is a type of investment fund that pools money from multiple investors to buy a diversified portfolio of assets such as stocks, bonds, or commodities. ETFs are traded on stock exchanges, similar to individual stocks, allowing investors to buy and sell shares throughout the trading day.

What Is an Ethereum ETF?

An Ethereum ETF (Exchange-Traded Fund) is an investment product that allows investors to gain exposure to Ethereum (ETH), the second-largest cryptocurrency by market capitalization, without directly owning the cryptocurrency itself.

Ethereum ETFs are typically structured in two ways:

Spot Ethereum ETFs

These ETFs directly hold Ethereum, meaning they buy and store actual ETH on behalf of investors. When you invest in a spot Ethereum ETF, the value of your shares directly reflects the price of Ethereum. As of 2024, spot Ethereum ETFs are still emerging, and regulatory approval varies by region.

Ethereum Futures ETFs

These ETFs are based on Ethereum futures contracts, not the cryptocurrency itself. Futures contracts are agreements to buy or sell Ethereum at a future date and predetermined price. Ethereum futures ETFs track the performance of these contracts, allowing investors to speculate on Ethereum’s future price movements without holding the actual asset.

Key features of Ethereum ETF

Indirect Exposure to Ethereum

Investors gain exposure to Ethereum (ETH) without directly purchasing or holding the cryptocurrency. This allows for participation in Ethereum’s price movements via a traditional financial product.

Exchange-Traded

Like stocks, Ethereum ETFs are traded on major exchanges. Investors can buy and sell shares during normal market hours, providing liquidity and flexibility compared to other investment vehicles.

Simplified Cryptocurrency Access

With an Ethereum ETF, investors do not need to manage cryptocurrency wallets, private keys, or understand blockchain technology. The ETF provider handles the custody and security of the underlying asset or contracts.

Regulated Investment Product

ETFs are typically offered by regulated financial institutions and traded on regulated stock exchanges, offering greater investor protection compared to direct cryptocurrency trading on unregulated platforms.

Diversification

Some Ethereum ETFs may offer a basket of assets, allowing for diversification by including other cryptocurrencies, related assets, or blockchain-related stocks, though most are focused on Ethereum alone.

Transparency

Ethereum ETFs often have daily transparency regarding their holdings or positions (in the case of futures), allowing investors to see what the fund owns.

Liquidity

ETFs are highly liquid because they can be traded like stocks. Investors can enter or exit their positions quickly, without the complications of converting fiat to cryptocurrency.

Fees and Costs

Ethereum ETFs typically charge an expense ratio or management fee, which can vary depending on the provider and the type of ETF (spot or futures). These fees can impact long-term returns.

Tax and Compliance

ETFs follow traditional tax rules for securities, which may simplify tax reporting compared to holding cryptocurrency directly, which can involve more complex capital gains calculations.

Leverage and Futures (for Futures ETFs)

Some Ethereum futures ETFs may use leverage, meaning they borrow to increase exposure to Ethereum price movements. This can amplify gains but also increase risk and potential losses.

Volatility

Ethereum is a highly volatile asset, and its price swings will be reflected in the value of the ETF shares. Futures-based ETFs may have additional volatility due to the complexities of futures contract pricing.

Accessibility

Ethereum ETFs can be purchased through traditional brokerage accounts, making them more accessible to a wider range of investors who may not be familiar with crypto exchanges or wallets.

How Does an Ethereum ETF Work?

Step 1: Investor Buys ETF Shares

Investors purchase shares of the Ethereum ETF through a brokerage account, just like buying stocks or other ETFs.

Step 2: ETF Tracks Ethereum (or Futures)

In a spot Ethereum ETF, the ETF provider holds physical Ethereum, and the share price reflects the real-time price of Ethereum.

In an Ethereum futures ETF, the provider holds futures contracts, and the ETF’s price reflects the performance of those contracts.

Step 3: Management of the Fund

The ETF provider manages the underlying Ethereum or futures contracts. In spot ETFs, they ensure the safekeeping of the Ethereum in secure storage. In futures ETFs, they manage futures positions and may periodically roll over contracts.

Step 4: Investors Gain or Lose Based on Ethereum’s Price

- In a spot ETF, if Ethereum’s price increases, the value of the ETF shares will rise. If Ethereum’s price drops, the ETF’s value decreases.

- In a futures ETF, the performance of the futures contracts determines gains or losses, which may not perfectly match Ethereum’s spot price.

Pros and Cons of Ethereum ETF

Benefits of Ethereum ETF

- Regulated Access: ETFs are typically traded on regulated exchanges, making it easier for traditional investors to gain exposure to Ethereum within a familiar financial structure.

- No Need for Direct Custody: Investors do not have to worry about storing Ethereum, private keys, or using cryptocurrency wallets. The ETF provider handles the security and storage.

- Tax and Compliance: Since ETFs are often subject to traditional investment rules, they may offer clearer tax and regulatory benefits than direct cryptocurrency ownership in some regions.

Risks of Ethereum ETF

- Tracking Errors: With futures-based ETFs, the performance may deviate from the actual spot price of Ethereum.

- Fees: ETFs come with management fees, which can eat into returns over time.

- Regulation: Cryptocurrency ETFs are subject to regulatory scrutiny, and changes in laws can affect the ETF’s performance or availability.

Conclusion

Ethereum ETFs are revolutionizing how investors access the world of cryptocurrencies by offering a familiar, regulated, and straightforward way to gain exposure to Ethereum. Whether through a spot ETF that directly holds Ethereum or a futures ETF that tracks its future price, these funds provide an entry point for traditional investors who may not want to navigate the complexities of crypto wallets, exchanges, or security concerns.

By combining the benefits of regulated financial products with the potential growth of Ethereum, ETFs open the door for more investors to participate in the rapidly evolving digital asset space. As cryptocurrency continues to mature, Ethereum ETFs are likely to play a pivotal role in bridging the gap between traditional finance and the decentralized world of blockchain. Whether you’re a crypto enthusiast or a cautious investor, understanding the ins and outs of Ethereum ETFs is key to navigating this exciting new frontier in investing.

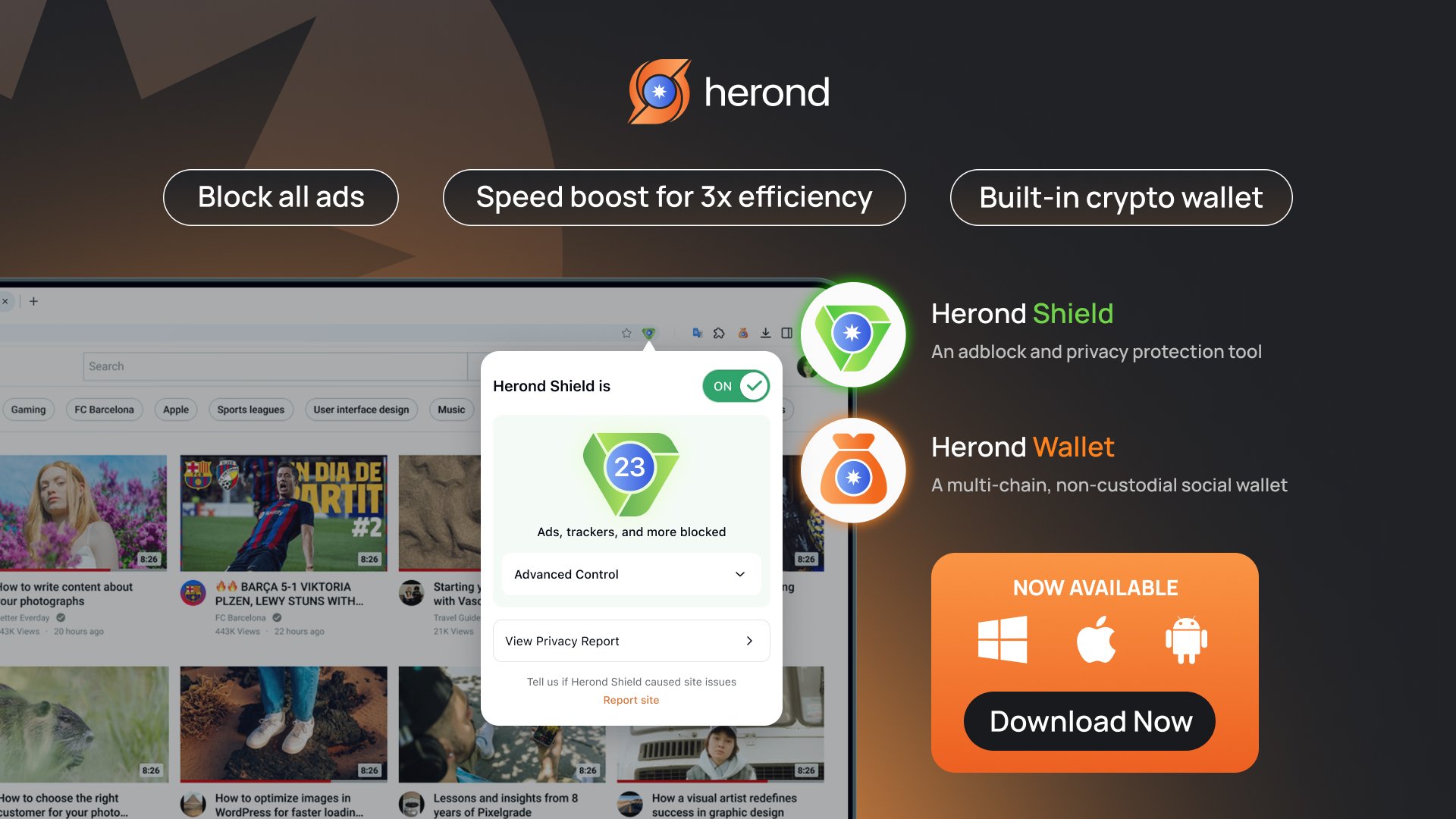

About Herond Browser

Herond Browser is a Web browser that prioritizes users’ privacy by blocking ads and cookie trackers, while offering fast browsing speed and low bandwidth consumption. Herond Browser features two built-in key products:

- Herond Shield: an adblock and privacy protection tool;

- Herond Wallet: a multi-chain, non-custodial social wallet.

Herond aims at becoming the ultimate Web 3.0 solution, heading towards the future of mass adoption. Herond has now released the mobile version on CH Play and App Store. Join our Community!