ATH is an important metric to support in the process of Cryptocurrency analysis. The reason behind this statement is that it can bring many benefits. This article will give you an introduction about the definition of ATH and its meaning to the Cryptocurrency market.

Besides understanding the overall information, it is necessary for us to know the detailed process to use ATH effectively. Let’s discover with us!

What is ATH?

ATH, short for “All-Time High”, is a popular term used in the cryptocurrency and financial markets. Literally, in the crypto market, it specifically denotes the highest price level that a particular cryptocurrency has achieved since it began trading on exchanges. In other words, it is a significant milestone that reflects the peak value of the cryptocurrency up to that point in time.

Benefits of ATH

ATH is an important metric for investors, traders, and analysts since it has many reasons as below.

- Performance Assessment: It provides insight into the historical performance of a cryptocurrency. It allows stakeholders to assess how well the cryptocurrency has performed in the past and compare it to its current price.

- Psychological Significance: It holds psychological significance for market participants. It represents the highest level of value that the cryptocurrency has ever reached. Therefore, it often generates excitement and optimism among investors.

- Market Sentiment Indicator: It can influence market sentiment and investor behavior. Reaching a new ATH may attract more attention and investment, contributing to positive sentiment and upward price momentum.

- Price Discovery: Breaking past previous ATH levels can signal bullish momentum and indicate the potential for further price appreciation.

- Confirmation of Trends: It can validate the uptrend and reinforce the narrative of growing adoption, positive developments, and increasing demand for the asset.

- Market Visibility and Attention: Reaching new ATH levels often attracts significant market attention since it shows increased visibility.

- Portfolio Performance Tracking: By comparing the current value of investments to previous levels, investors can assess portfolio growth, profitability, and overall performance over time.

- Optimism and Confidence: Reaching new ATH levels can instill optimism and confidence among investors, driving positive sentiment and encouraging further investment.

ATH vs ATL: A brief comparison

Let’s discover the key differences between ATH and ATL in the below table.

| ATH | ATL | |

| Definition | Refer to the highest price level ever reached by an asset since its inception or listing on an exchange. | Refer to the lowest price level ever reached by an asset since its inception or listing on an exchange. |

| Psychological Impact | Reaching a new ATH can have a positive psychological impact on investors, reinforcing optimism in the asset. | Hitting a new ATL can have a negative psychological impact on investors, leading to pessimism in the asset. |

| Market Dynamics | Breaking past previous ATH levels can signal bullish momentum, price discovery, and potential for further price appreciation. → Attract new investors and increase trading activity. | Reaching new ATL levels may indicate oversold conditions, capitulation, and potential bottoming out of the asset’s price.→ Attract value investors looking for opportunities to buy low. |

| Historical Reference | To assess the growth trajectory, and market sentiment over time. | To evaluate the asset’s price declines and potential for recovery or turnaround. |

| Investment Strategy | Used as a reference point for setting price targets or adjusting their investment strategies. | Used as a potential entry point for long-term investment or swing trading strategies. |

How to use ATH effectively: A Step-by-Step Guide

Here’s a step-by-step guide on how to use ATH effectively:

Step 1: Research and Analysis

Conduct thorough research and analysis of the cryptocurrency to understand its fundamentals, technology, market dynamics, and potential use cases. Then, analyze its historical price data and identify previous ATH levels.

Step 2: Identify ATH Levels

Identify the previous ATH levels of the cryptocurrency by examining historical price charts. You should note the dates and price levels at which the cryptocurrency reached its previous ATH.

Step 3: Monitor Current Price Movements

At this stage, you should pay attention to whether the cryptocurrency is approaching its ATH, surpassing it, or experiencing a correction from it.

Step 4: Evaluate Market Sentiment

Then, you should also assess market sentiment surrounding the cryptocurrency. For example, through news, announcements, developments, investor sentiment, and overall market conditions.

Step 5: Use ATH as a Reference Point

Use ATH as a reference point for evaluating the cryptocurrency’s price performance. Compare the current price to its previous ATH levels to gauge its growth potential and assess whether it’s trading at historically high or low levels.

Step 6: Consider Risk and Reward

Evaluate whether the potential rewards outweigh the risks of buying at or near ATH levels.

Step 7: Diversify Your Portfolio

Allocate your funds across different cryptocurrencies with varying risk profiles and growth potential. Avoid putting all your investment capital into cryptocurrencies that are trading at or near their ATH levels.

Step 8: Set Realistic Expectations

Set your expectation with the understanding that reaching a new ATH does not guarantee sustained price appreciation, and corrections or pullbacks are common after significant price rallies.

Step 9: Risk Management

Set stop-loss orders, establish exit strategies, and avoid investing more than you can afford to lose. Consider using dollar-cost averaging or scaling into positions gradually.

Step 10: Stay Informed and Adapt

Stay informed about developments in the cryptocurrency market and be prepared to adapt your investment strategy accordingly.

Conclusion

ATH is significant because it represents the peak value that the asset has achieved, indicating strong demand, positive sentiment, and potential for further price appreciation.

Therefore, using this term as a reference point in your cryptocurrency investing strategy, you can make more informed decisions and navigate the market effectively. However, you should always remember that investing in cryptocurrencies carries inherent risks, and past performance is not indicative of future results.

About Herond Browser

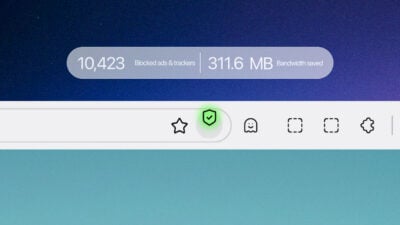

Herond Browser is a Web browser that prioritizes users’ privacy by blocking ads and cookie trackers, while offering fast browsing speed and low bandwidth consumption. Herond Browser features two built-in key products:

- Herond Shield: an adblock and privacy protection tool;

- Herond Wallet: a multi-chain, non-custodial social wallet.

Herond aims at becoming the ultimate Web 2.5 solution that sets the ground to further accelerate the growth of Web 3.0, heading towards the future of mass adoption.

Join our Community!